3D Secure and PSD2 for Visa Payments: Reduce Fraud Without Killing Conversion

Online visa fees are among the highest-risk transactions in travel: they are card-not-present, often cross-border, and frequently involve first-time customers using unfamiliar channels. According to the European Central Bank, cross-border e-commerce fraud still represents more than 60 % of all card fraud in Europe (2024 report). Yet over-zealous security checks can tank completion rates and wipe out the very ancillary revenue that visa services promise.

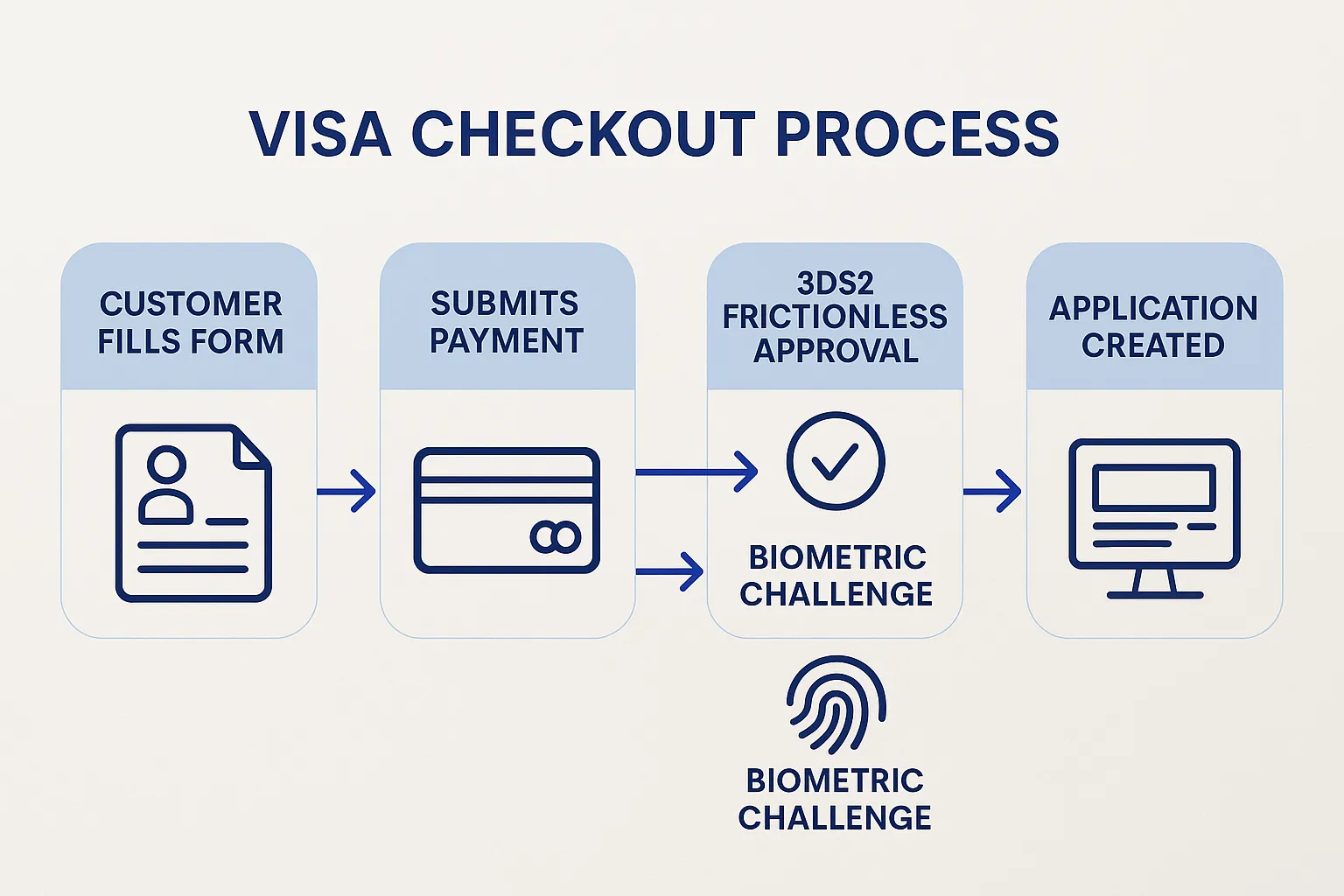

The good news? PSD2’s Strong Customer Authentication (SCA) rules and the new 3-D Secure 2 (3DS2) protocol offer a way to cut fraud while preserving – or even improving – conversion. This guide explains how travel brands can deploy 3DS2 intelligently in visa payment flows, secure compliance, and protect revenue.

PSD2, SCA, and Why They Matter for Visa Fees

PSD2 is the European Union’s second Payment Services Directive. Since 2021, it has forced most electronic payments in the European Economic Area to pass Strong Customer Authentication. SCA requires two out of three factors—something the customer knows, has, or is. In practice, that means most online card payments must be routed through an authentication step such as 3-D Secure.

Because visa purchases are:

- Almost always remote card-not-present transactions

- Frequently cross-border (triggering higher fraud rules)

- Often processed by EU acquirers—especially for OTAs, airlines, and aggregators headquartered in Europe

…PSD2 compliance is non-negotiable. Non-compliant payments are routinely declined by issuers, leading to abandoned applications, angry customers, and lost ancillary revenue.

From 3-D Secure 1.0 to 3-D Secure 2: A Quick Refresher

| Feature | 3-D Secure 1.0 | 3-D Secure 2.0 |

|---|---|---|

| Release year | 2001 | 2019 |

| Interface | Browser redirect, static password | Embedded iframe or in-app, biometric or OTP |

| Data shared with issuer | ~15 data points | >100 data points (device, merchant, risk) |

| Frictionless flow | Rare | Default if issuer risk score is low |

| Mobile UX | Poor, high failure rate | Native SDKs, one-tap authentication |

| PSD2 SCA compliance | Partial | Full |

3DS2 dramatically improves both security and user experience by sending rich device and transaction data behind the scenes. Issuers can approve low-risk payments without any extra steps, while high-risk transactions trigger a step-up challenge (SMS OTP, biometric, banking app, etc.). The result: fewer false declines and happier customers.

Common PSD2 Exemptions Relevant to Visa Payments

Not every transaction requires a customer challenge. Merchants and their acquiring banks can flag exemptions, but issuers make the final call. Here are the ones most relevant to visa fees:

| Exemption | How it works | Typical Visa-Payment Use Case | Max value | Risk threshold |

|---|---|---|---|---|

| Low-value (LVT) | Payments under €30; every fifth cumulative transaction must be challenged | Cheap ETAs or low-fee eVisas | €30 | N/A |

| Transaction Risk Analysis (TRA) | Acquirer certifies portfolio fraud below set thresholds | Large travel sellers with proven low fraud rates | €100–€500 depending on fraud rate | 0.01 – 0.13 % |

| Corporate payments | “Lodged” or virtual corporate cards | TMC booking visas for employees | None | N/A |

| Mail Order / Telephone Order (MOTO) | Out of scope for SCA | Call-centre visa upsells | None | N/A |

If you operate at scale, the TRA exemption is the real conversion booster. By maintaining low fraud (below 0.13 % for transactions up to €500) you can request frictionless approvals for most visa payments.

6 Best Practices to Cut Fraud Without Killing Conversion

- Collect rich data before you fire 3DS2. Device ID, browser language, IP geolocation, and previous SimpleVisa session data help issuers trust the transaction.

- Route through the right BIN ranges. Some issuers have not fully adopted 3DS2 data fields. Use your PSP’s smart-routing or exemptions engine to maximise frictionless rates.

- Optimise the 3DS2 fallback UX. When a challenge is required, keep the customer on the same page or in-app. Our article Why Travelers Abandon Visa Forms—and 6 UX Fixes That Convert offers copy ideas that calm users.

- Use white-label or API tokenisation. Storing payment tokens lets returning users pay for additional passengers or visas with fewer steps and still satisfy SCA via merchant-initiated transactions.

- Monitor attach-rate KPIs, not just fraud. Track visa-related conversion rate, approval rate, and ancillary revenue per booking. See 5 KPIs to Track After Deploying a Visa Management Platform for dashboard templates.

- Feed issuer feedback loops. Modern PSPs let you pass post-transaction fraud results back to issuers, improving future frictionless approvals. Enable these webhooks in your integration.

Implementation Checklist for Travel Brands

- Map your payment flows. Identify which visa products are subject to PSD2 (EU acquirer, EU cardholder) and which aren’t (non-EEA issuers, PayPal).

- Choose a 3DS2-capable PSP or gateway. Verify support for exemption flagging, TRA thresholds, real-time risk scoring, and out-of-band challenges.

- Embed 3DS2 in your SimpleVisa flow. If you use our widget, SCA logic is pre-integrated. API users can add the

sca_exemptionandchallenge_window_sizefields as shown in the Developer Q&A. - Run A/B tests. Compare frictionless vs. challenge traffic and measure drop-off at each step. Adjust exemption logic accordingly.

- Set fraud-rate alerts. Staying below TRA thresholds unlocks frictionless volumes. Use BI tools or SimpleVisa webhooks to trigger alerts if fraud spikes.

- Educate customer-support teams. Train agents to explain SCA text messages, banking-app pushes, and common failure codes. A quick script can save a sale.

Measuring Success: Benchmarks to Aim For

- Frictionless rate: 75 – 85 % for EU cardholders after three months of optimisation

- Challenge success rate: >85 % if you provide clear on-screen instructions and fallbacks

- Overall approval rate: >95 % for low-risk markets; >92 % globally

- Fraud-to-sales ratio: <0.13 % to keep TRA exemption for up to €500

If your numbers are below these, review data-quality fields, issuer mappings, and customer messaging.

Frequently Asked Questions

Does 3DS2 apply to American travelers paying with US cards? 3DS2 is optional outside the EEA and UK. However, many US issuers now support it. Enabling 3DS2 can still lower chargebacks and shift liability to the issuer.

Can I skip SCA for corporate travel portal payments? Corporate or lodge cards used via a secure channel may qualify for the corporate-payments exemption. Check with your acquirer and document the use case.

Will adding 3DS2 slow down the visa checkout? A frictionless 3DS2 transaction typically adds <300 ms. Step-up challenges add 10–30 s but affect only a minority of payments when exemptions and good risk data are in place.

What happens if the issuer times out? Most PSPs fall back to soft declines. You can prompt the traveler to retry or offer an alternative payment method (PayPal, open banking) to rescue the booking.

Ready to Secure Payments and Boost Revenue?

SimpleVisa’s widget and API come with 3-D Secure 2 built in, PSD2-ready exemption toggles, and real-time fraud analytics. That means fewer chargebacks and higher visa attach rates—all without extra code. If you want to see how painless compliant payments can be, book a live demo today and let us tailor a fraud-conversion strategy for your travel brand.