B2B Pricing Models for Visa Management Platforms: Pros, Cons, and Benchmarks

The commercial potential of digital visa processing is no longer a nice-to-have. A 2024 IdeaWorksCompany study estimates that compliance-related ancillaries (visas, ETAs and health passes) will top $8.4 billion in airline revenue alone by 2027.¹ Yet many travel brands still hesitate because pricing for visa management platforms can look opaque or hard to benchmark.

This guide breaks down the most common B2B pricing models, highlights their strengths and drawbacks, and shares real-world benchmarks drawn from SimpleVisa network data and public filings. Whether you run an OTA, airline, cruise line or TMC, you will leave with a clear framework for negotiating a contract that aligns with your volumes, margins and risk appetite.

Why Pricing Architecture Matters

- Profitability: Visa services can add up to 3–6 % ancillary margin per booking when priced correctly.

- Conversion: Poorly aligned fees can deter customers or push them off your platform to third-party sites.

- Forecasting: Fixed vs variable cost structures change how you model break-even volumes and ROI.

- Compliance risk: Under-funded support SLAs lead to denied boardings and fines. Paying the right price for quality data and automation is cheaper than penalties.

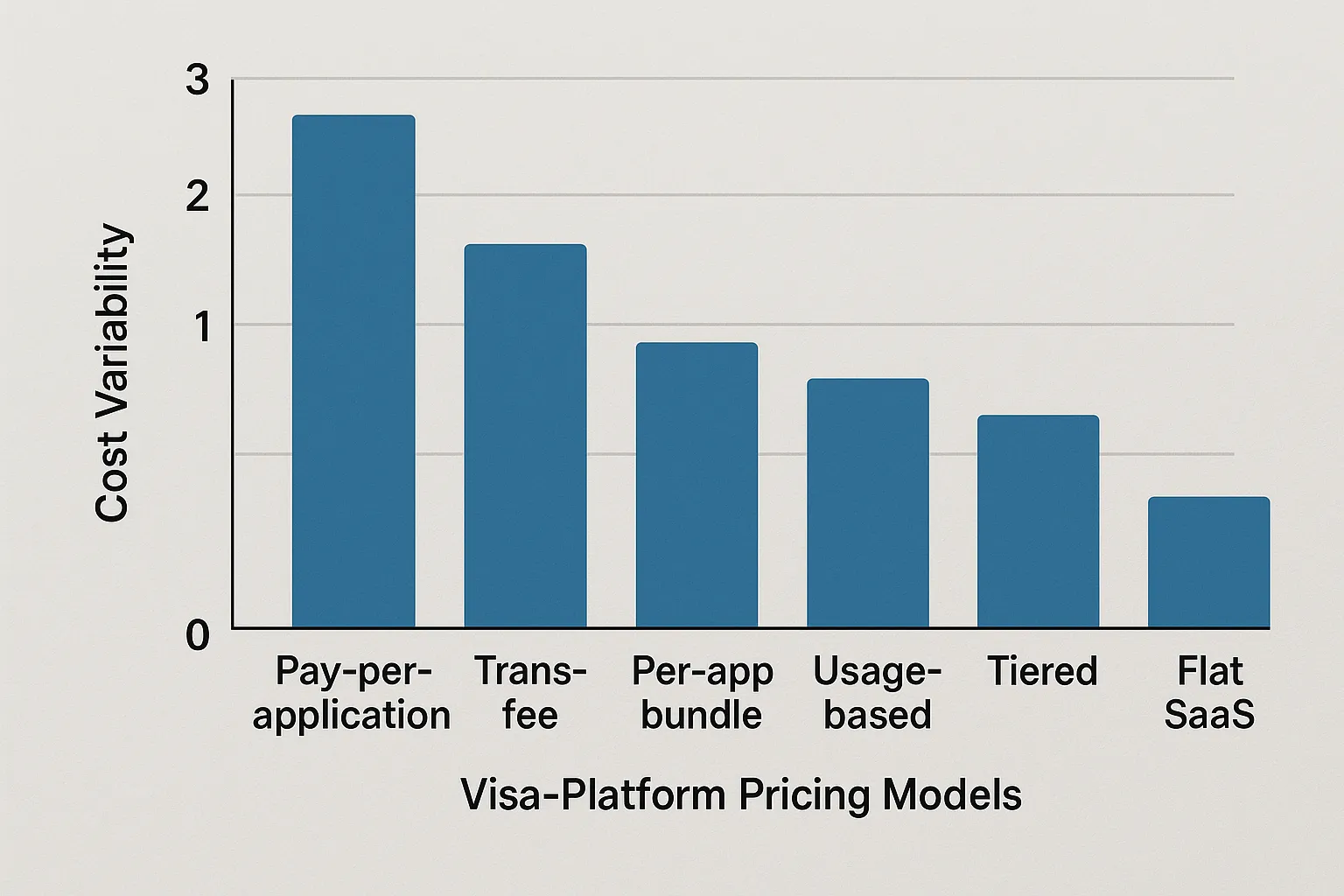

We will explore six pricing archetypes you will encounter when evaluating vendors like SimpleVisa, but first a quick visual comparison.

1. Pay-per-Application (Transactional)

How it works:

- You are charged a fixed wholesale fee—typically $6–$12 per completed application—only when a traveller submits and pays.

- Often paired with an optional markup you set at checkout.

Pros

- Zero fixed cost; ideal for pilots and low volumes.

- Easy P&L attribution: every transaction is profitable or can be waived for VIPs.

Cons

- Unit economics may erode at scale compared with tiered or subscription deals.

- Encourages vendors to prioritise volume over long-term support unless SLAs are explicit.

Best for: OTAs testing a new upsell, regional airlines, event-driven spikes (e.g., World Expo).

Benchmark: SimpleVisa partners under 25 k annual applications average $8.90 wholesale and a 9.7 % attach rate.²

2. Revenue-Share or Commission

How it works:

- The platform sets the retail price. You receive 10–30 % of the traveller-paid fee for each approved visa.

- No direct cost if the customer does not buy.

Pros

- Aligns incentives on conversion and UX.

- Allows you to present a “price-inclusive” experience with no extra line items.

Cons

- Lower control over retail pricing and branding elements.

- Accounting complexity: gross vs net revenue recognition can affect reported ancillaries.

Best for: Meta-search sites, mobile-first superapps, loyalty programmes.

Benchmark: Across 11 global OTAs, median commission stands at 18 % with a high of 28 % in GCC corridors.³ For airlines, commissions average 14 % because of stricter brand guidelines.

For a deep dive on commission structures, see our internal post 7 Revenue-Sharing Models for Online Visa Processing Partners.

3. Flat-Rate SaaS Subscription

How it works:

- A monthly or annual licence for a back-office portal, workflow engine or API access.

- Typical tiers map to application volume (e.g., up to 5 k, 25 k, 100 k transactions per year).

Pros

- Predictable budgeting and easier CAPEX/OPEX allocation.

- Lower marginal cost once volumes exceed the tier break.

Cons

- You pay even during seasonal troughs.

- Finance teams may need a usage “true-up” to avoid over-paying for unused capacity.

Best for: Large TMCs, cruise lines and tour operators with steady year-round demand.

Benchmark: Annual licences range $24 k–$180 k. Break-even vs transactional pricing often sits around 40 k applications/year.

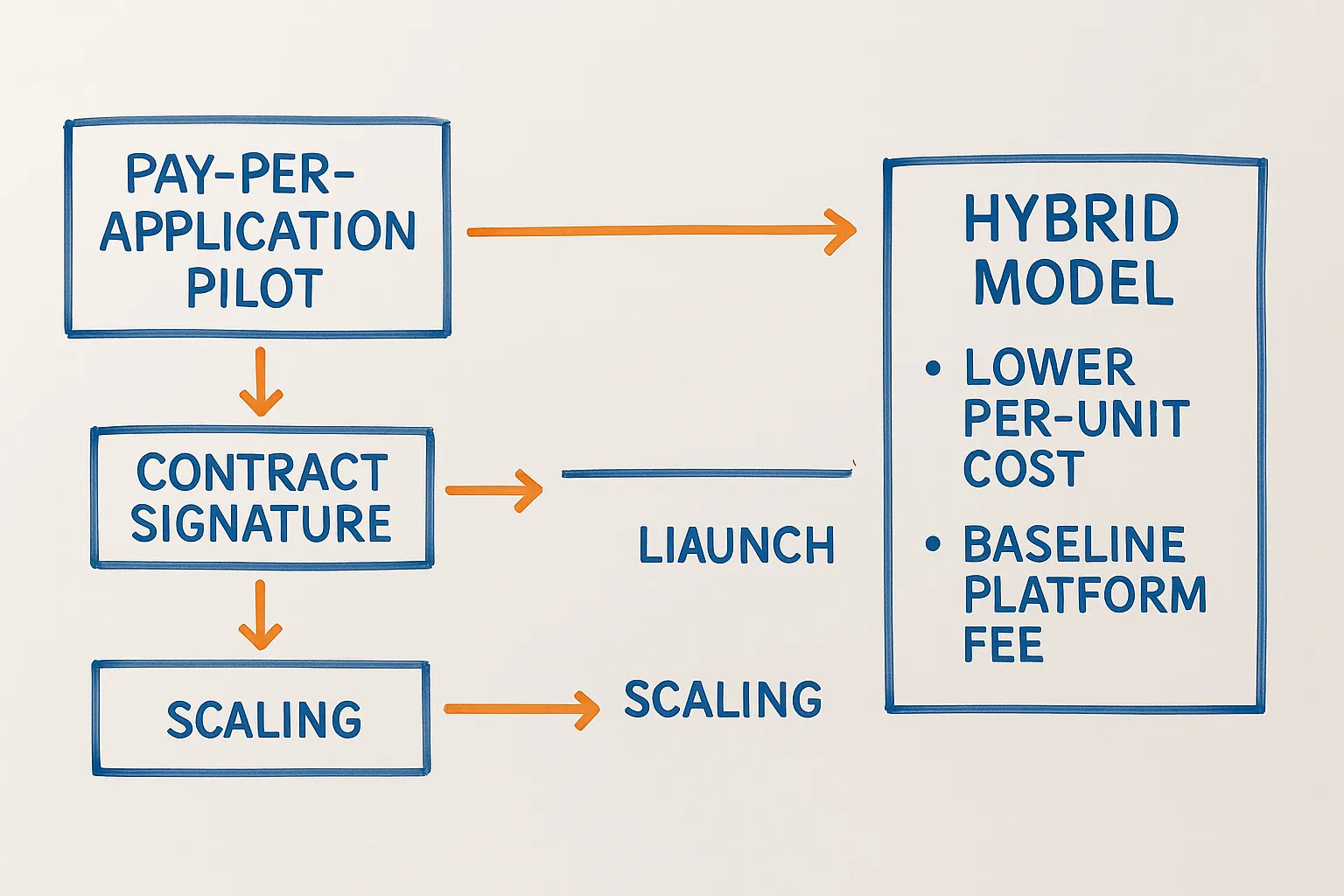

4. Hybrid (Base + Usage)

How it works:

- Combines a modest platform fee (e.g., $1 k/month) with discounted per-application charges.

- Volume tiers reduce the transactional rate as you grow.

Pros

- Balances predictability with upside savings at scale.

- Vendors reinvest the baseline fee into better SLAs and road-map commitments.

Cons

- Can be harder to model for CFOs compared with single-line pricing.

Best for: Fast-growing OTAs and airlines migrating from pilot to rollout.

5. White-Label Licensing

How it works:

- You license a fully branded web or mobile application hosted by the vendor.

- Fees may be flat (white-label portal at $2 k/month) or usage-based, plus optional setup/branding costs.

Pros

- Speed: live in days without engineering resources (see How to Offer White-Label Visa Services Without Writing Code).

- Full customer ownership, cross-sell and remarketing opportunities.

Cons

- Less UI control than a direct API integration.

- May duplicate data across systems if not integrated.

Best for: National airlines, loyalty programmes, destination marketing organisations.

Benchmark setup fees: $5 k–$15 k one-off for custom domain, theme and SSO.

6. Data-Only or API Licensing

How it works:

- Access to eligibility rules, document checklists and status webhooks via API.

- Price per 1 k API calls (e.g., $30–$90) or an annual data licence.

Pros

- Perfect fit for in-house build strategies and multi-modal travel-tech stacks.

- Can power pre-trip emails, app push notifications and agent dashboards.

Cons

- Requires engineering bandwidth and maintenance.

- You still need a submission/filing workflow—build or buy—that adds indirect cost.

Best for: Global distribution systems (GDS), super-apps, and enterprise travel platforms.

For integration context, read Future of Travel APIs: From Flights to Visas in a Single Call.

At-a-Glance Comparison Table

| Model | Cost Predictability | Typical Gross Margin* | Time to Launch | Ideal Monthly Volume |

|---|---|---|---|---|

| Pay-per-Application | Low | 20–40 % markup | <30 days | 0–10 k |

| Revenue-Share | Medium | 10–30 % commission | 1–3 weeks | 5–50 k |

| Flat SaaS | High | 60–80 % after break-even | 4–8 weeks | 40 k+ |

| Hybrid | Medium-High | 40–70 % | 3–6 weeks | 10–100 k |

| White-Label Licence | High | 50–70 % | 2–4 weeks | 3 k+ |

| Data API Licence | High | N/A (resell optional) | 6–12 weeks | Any (tech-heavy) |

*Gross margin here refers to potential mark-up or commission retained by the partner, not vendor profit.

Five Levers That Influence Your Final Quote

- Annual application forecast: Vendors reward guaranteed minimums with lower per-unit rates.

- Approval rate: Higher approval = less support cost for the vendor and potential discounts.

- Integration model: API deals often carry higher base fees but lower per-submit charges than white-label widgets.

- Geographic mix: Routes with mandatory eVisa (India, Kenya, Türkiye) have higher natural attach rates, allowing flexible pricing.

- Service level: 24/7 multilingual chat, dedicated account managers and custom compliance reporting add 10–25 % to list price.

For a holistic TCO analysis, consult The Hidden Costs of Manual Visa Processing (and How to Eliminate Them).

Negotiation Checklist

- Map your annual passenger segments: leisure vs corporate, visa-sensitive corridors, booking window.

- Model attach-rate scenarios (conservative, base, aggressive) and overlay pricing tiers to find break-even.

- Request historical approval-rate data by nationality to budget for support overhead.

- Validate SLA wording on uptime (>= 99.9 %), decision latency and support response.

- Clarify who eats government fee fluctuations—pass-through or vendor-absorbed margin.

- Ensure GDPR/PCI compliance is included, not optional.

Making the Choice: Decision Matrix

| Priority | Recommended Model |

|---|---|

| Test market fit quickly | Pay-per-Application or Revenue-Share |

| Maximise margin at high scale | Flat SaaS or Hybrid |

| Launch without engineering | White-Label Licence |

| Leverage in-house UX & data | API Licence |

Case Snapshot: Mid-Size OTA Moves from Transactional to Hybrid

- Starting point: 12 k annual visa transactions at $9.50 wholesale → $114 k cost.

- Switch: $2 k monthly platform fee + $5.90 per application.

- Outcome: Break-even at 4 k apps/month exceeded in month five. First-year savings: $38 k, plus 24 % faster completion times due to upgraded SLA.

Key Takeaways

- There is no one-size-fits-all model. Align pricing with your volume curve, engineering capacity and profit targets.

- Transactional and revenue-share are fastest to launch, but hybrid or subscription delivers better long-term margin.

- Ask for data: approval rate, attach rate by nationality and historical uptime.

- Remember hidden costs—manual form fixes, denied boarding fines, chargebacks—when comparing quotes.

- Revisit your contract annually; attach rates shift quickly as ETIAS and other mandates roll out.

Ready to benchmark your own numbers? Book a 30-minute SimpleVisa pricing workshop to get a custom model and ROI forecast tailored to your traffic and tech stack.

¹ IdeaWorksCompany & CarTrawler 2024 Ancillary Revenue Yearbook, p. 17.

² SimpleVisa network analytics, Jan 2024–Jun 2025.

³ Public filings and partner data aggregated July 2025.