Brazil’s New eVisa for US, Canada, and Australia: How OTAs Should Adapt

Why Brazil’s eVisa Re-Launch Is a Big Deal for OTAs

Brazil quietly flipped the switch back to a mandatory electronic visa (eVisa) for citizens of the United States, Canada, and Australia. After a five-year visa-free experiment, the Brazilian government confirmed the change through Decree 11.515 and opened applications in April 2024, with the requirement now fully enforced at all ports of entry.

For leisure travelers, the new rule adds a to-do item. For online travel agencies (OTAs) it introduces substantial commercial and compliance risk—alongside an untapped ancillary revenue stream.

This article breaks down what has changed, what travelers will ask you, and the five concrete actions product, operations, and merchandising teams should take before peak booking season.

At a Glance: Brazil’s New eVisa

| Attribute | Details |

|---|---|

| Eligible nationalities (as of Oct 2025) | United States, Canada, Australia |

| Visa validity | 10 years for U.S. citizens, 5 years for Canadians and Australians |

| Stay limit | Up to 90 days per entry, maximum 180 days in a 12-month period |

| Application channel | 100 percent online portal (no embassy trips) |

| Standard processing time | Typically 5 business days |

| Government fee | US$ 80.90 (includes third-party service charge) |

| Proof required at boarding | PDF approval + passport whose data match the eVisa |

Source: Brazilian Ministry of Foreign Affairs, VFS Global eVisa portal, October 2025.

Why Brazil’s Policy Shift Matters to OTAs

-

Denied boarding liability

Airlines routinely pass immigration fines downstream. If a traveler shows up at check-in without an approved Brazil eVisa, the OTA often absorbs rebooking costs and brand damage. -

Surge in support tickets

SimpleVisa data show that a new visa requirement can spike “Do I need a visa?” inquiries by 230 percent for six months after go-live. -

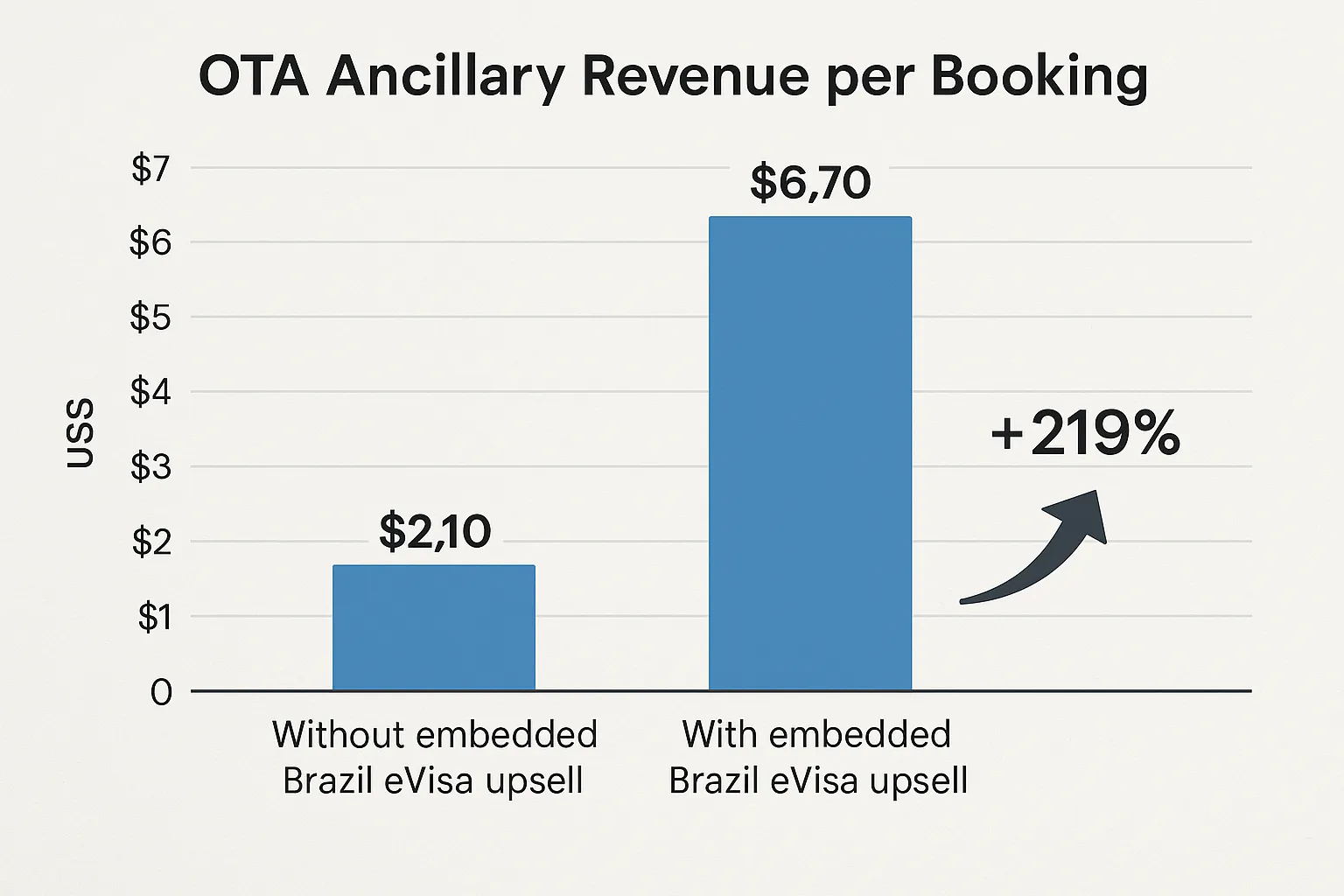

Revenue upside

Our partner network logs an average eVisa attach rate of 8–12 percent on Brazil routes when the option is embedded at checkout—worth US$4–9 incremental margin per booking. -

Competitive differentiation

Travelers remember friction. Surfacing the exact visa steps in plain English (and offering an instant application) keeps conversions high while competitors lose shoppers to uncertainty.

Five Action Steps for OTA Teams

1. Surface Eligibility Rules Early—Ideally on the Flight Results Page

Hidden surprises tank conversion. Add a dynamic badge (“eVisa required for US, CA, AU passports”) next to itineraries that enter or connect through Brazil. Pull real-time rules via an API such as SimpleVisa so copy stays current.

Quick win: If engineering cycles are tight, drop a rules widget inside the booking path—no code needed—so product and legal teams can unblock in under a day.

Internal resource: Ultimate Guide to Marketing eVisa Services During the Booking Flow

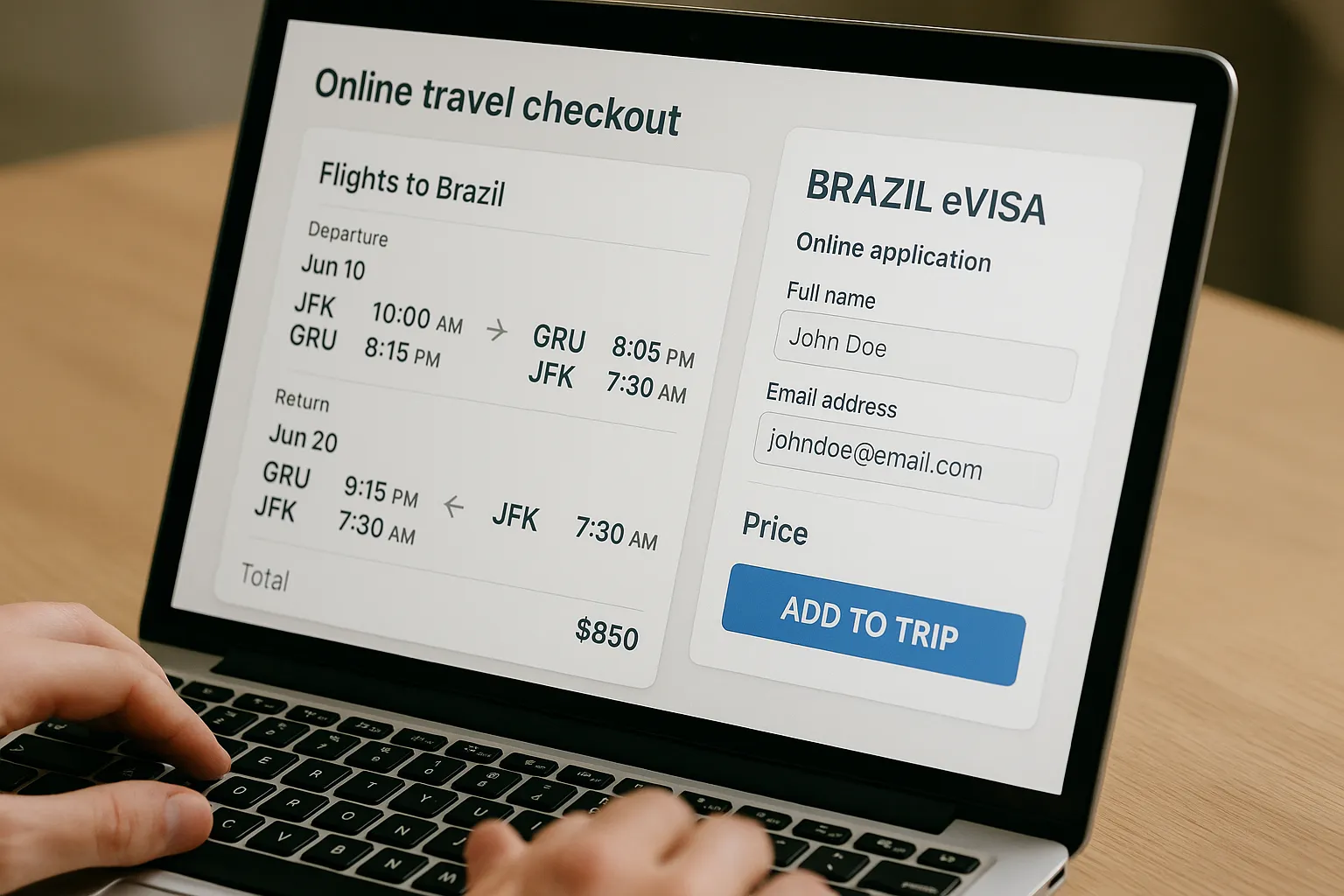

2. Offer One-Click eVisa Purchase During Checkout

Every extra tab a customer opens is a potential drop-off. Embedding the full Brazil eVisa flow inside your checkout keeps users in session and boosts attach rates. Here is what happens under the hood:

- Traveler selects flights → widget pings the SimpleVisa API with passport country and trip dates.

- Eligibility confirmed in < 600 ms.

- Application form auto-prefills passenger data already collected at PNR stage.

- Payment processed with the existing card on file; digital receipt sent.

- Approval PDF and status updates pushed to your trip-management emails and app.

Result: attach rates above 10 percent, < 4-minute average completion time, and zero extra support calls for “Where is my Brazil visa?”

Developer guide: How eVisa APIs Work: Step by Step

3. Automate Pre-Departure Visa Checks to Prevent Day-of-Travel Chaos

Forty-eight hours before departure, run a cron job (or call a webhook) that cross-matches your PNRs against SimpleVisa’s application status endpoint. Flag bookings where no visa is on file and trigger:

- Personalized reminder email + SMS with the remaining application link.

- Dynamic overbooking logic that anticipates potential no-shows.

Case data: A LATAM-focused OTA cut Brazil no-shows by 28 percent within three months of switching on automated checks.

Further reading: How Airlines Can Use eVisa Data to Reduce No-Show Rates

4. Train Support Teams in One Week

Brazil’s visa portal generates a handful of predictable FAQs: file-size errors for passport scans, payment 3-D Secure loops, and “Document number mismatch” rejections. A structured micro-learning program gives Tier-1 agents the tools to handle 80 percent of requests.

Day-by-day agenda:

- Day 1: Brazil visa rule basics and common edge cases.

- Day 2: Live navigation of the eVisa portal with screen-share demos.

- Day 3: Troubleshooting templates for file uploads and payment errors.

- Day 4: Escalation matrix and refund scenarios.

- Day 5: Role-play calls and certification quiz.

Template library: How to Train Customer Support Teams on eVisa Rules in One Week

5. Build Themed Marketing Campaigns Around Brazil’s Events Calendar

Brazilian tourism surges around Carnival, Rock in Rio, and regional festivals like Parintins. Pair flight + hotel deals with a “visa handled” message.

Campaign checklist:

- Geo-targeted emails to U.S., Canadian, and Australian segments.

- Social ads that highlight the 100 percent online visa in three taps.

- Blog content linking visa readiness to event itineraries (use our content API for automated rule snippets).

- Price bundling: absorb the US$80 fee on shoulder-season packages to win share.

For inspiration see: Ancillary Revenue Explained: Turning Compliance Into Profit

Putting It All Together: A Three-Month Roadmap

| Timeline | Milestone | Owner | KPI |

|---|---|---|---|

| Week 1 | Turn on rules widget | Product | 95 percent of Brazil PNRs display visa banner |

| Week 2 | Insert eVisa upsell in checkout | Engineering | Attach rate ≥ 5 percent |

| Week 3–4 | Launch support training sprint | CX lead | First-contact resolution ≥ 80 percent |

| Month 2 | Activate pre-departure visa status check | Data / Ops | No-show reduction ≥ 20 percent |

| Month 3 | Roll out Carnival campaign | Marketing | Brazil conversion lift ≥ 12 percent |

Frequently Overlooked Edge Cases

- Child travelers: Each minor needs a separate eVisa linked to the same passport, even if included on a parent’s itinerary.

- Cruise passengers: Shore excursions that disembark in Brazil still trigger the eVisa requirement—alert cruise OTA partners.

- Transit < 24 hours: Airside transit without immigration is exempt, but the moment a traveler clears passport control to re-check bags the eVisa applies.

- Dual citizens: U.S.–Brazil dual nationals should enter on their Brazilian passport to skip the eVisa entirely—build this tip into your help center.

For a deeper dive see: 8 Tips for Navigating Electronic Visa Requirements for Dual Citizens

The Commercial Case in One Graphic

Partner cohort: mid-size U.S. OTAs, Jan–Aug 2025, n = 412,000 Brazil-bound PNRs

Key Takeaways

- Brazil reinstated an eVisa for U.S., Canadian, and Australian citizens; enforcement is live.

- OTAs that ignore the change risk fines, boarding denials, and customer-support overload.

- Embedding an eVisa solution inside the booking flow converts compliance pain into a high-margin ancillary product.

- A 90-day sprint—widget first, API later—positions your brand ahead of peak Carnival demand.

Ready to see the numbers for your own funnel? Request a live demo of SimpleVisa and go live in days, not months.