Ancillary Revenue Explained: Turning Compliance Into Profit

Why ancillary revenue matters more than ever in 2025

Ask any airline, OTA, or cruise line where their profits really come from and they’ll point to the items you don’t see on the ticket’s face value: bags, seat selection, insurance, credit-card kickbacks—and increasingly, travel documentation services.

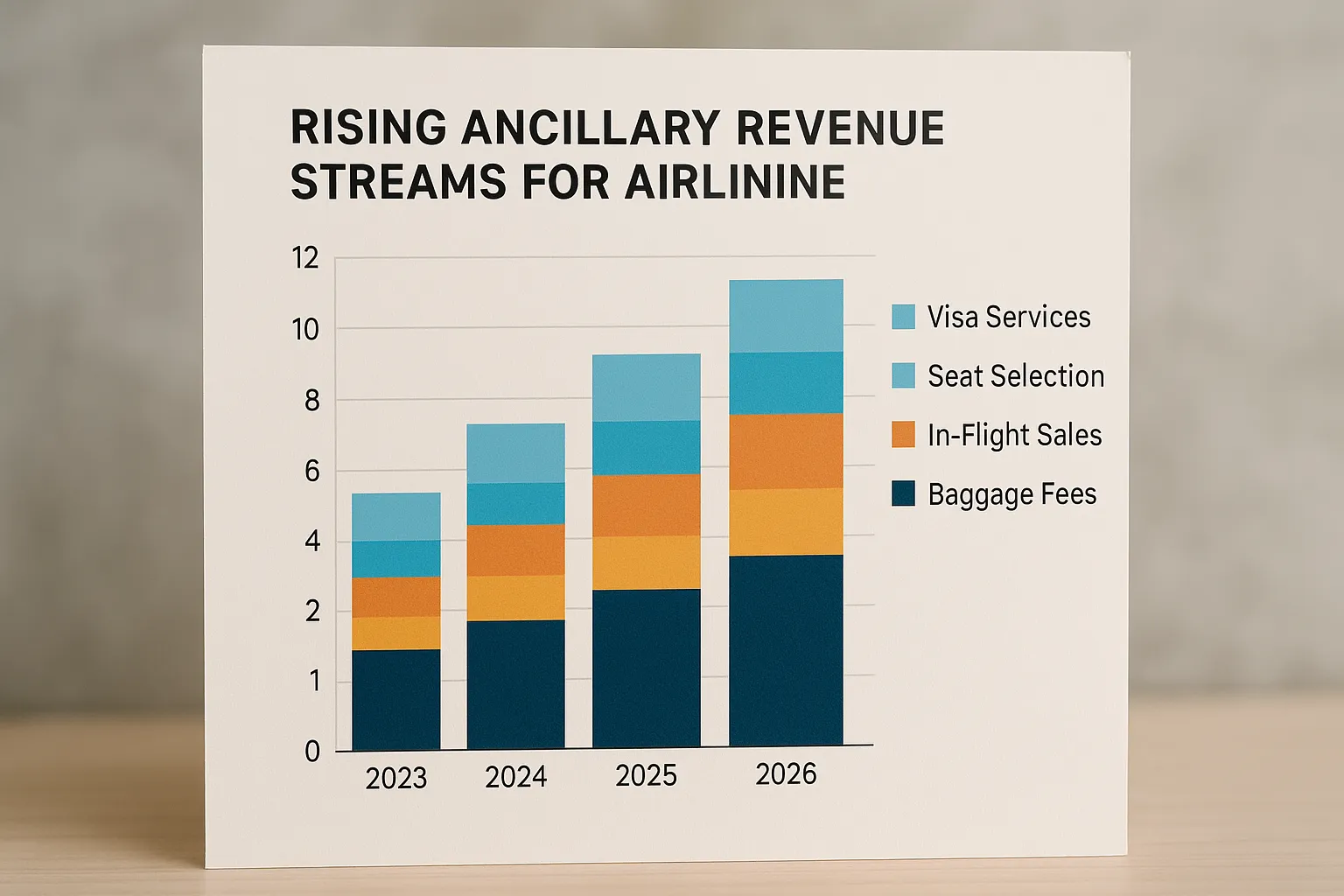

According to IdeaWorksCompany, global airline ancillary revenue hit US $117.9 billion in 2024, up 7.7 % year-on-year, even while base fares stagnated. Margin-friendly extras are no longer optional; they’re the financial engine that keeps schedules in the air.

Yet one of the most obvious add-ons is still missing from most booking flows: helping passengers comply with ever-tighter border regulations. Done right, visa compliance can transform from a cost center (think fines for inadmissible travelers) into a predictable, high-margin profit stream.

From headache to goldmine: the compliance paradox

- Mandatory by law – Airlines face carrier fines of up to US $10 000 per inadmissible passenger in many jurisdictions. Ferries, cruise lines, and OTAs risk chargebacks and reputation damage if customers are denied boarding.

- Painful for travelers – 37 % of passengers abandon a booking when the visa situation looks complicated (Phocuswright, 2024). Confusion equals churn.

- Low ownership – Most travel brands still outsource visa information to generic FAQs or external government pages, forfeiting the chance to keep the customer—and their spend—inside the funnel.

SimpleVisa flips that script. By embedding a real-time visa eligibility check, guided eVisa form, and one-click payment inside the booking path, partners both protect compliance and earn a fee on each successful application.

Turning a legal obligation into a positive P&L entry is the textbook definition of ancillary revenue.

How much money is on the table?

Let’s run the numbers for a mid-size airline carrying 5 million international passengers per year.

| Metric | Conservative estimate |

|---|---|

| % of pax requiring some form of visa or ETA | 35 % |

| Conversion rate when visa service is offered at checkout | 50 % |

| Average service fee / commission per application | US $12 |

| Annual ancillary revenue | US $10.5 million |

That’s before counting indirect gains like lower denied-boarding costs or higher NPS scores.

Common ancillary models for visa compliance

- Fixed convenience fee

Charge a flat amount (e.g., US $15) for processing each passenger’s eVisa or ETA through an embedded flow. - Revenue share

Earn a percentage of the official visa cost or of the margin set by a third-party processor like SimpleVisa. - Subscription bundle

Include “Documentation Assist” inside a premium fare family or loyalty tier, boosting perceived value. - Data licensing

Sell aggregated, anonymized demand data back to destination marketers or airports.

Whichever model you pick, the tech backbone is similar: a visa management platform that integrates via API or no-code widget.

A quick refresher: what does a visa platform actually do?

If you’re new to the space, start with our deep dive on how eVisa APIs work. In short, a platform like SimpleVisa:

- Pulls live border rules for 220+ jurisdictions.

- Pre-populates forms with PNR or passenger profile data.

- Handles payments to government portals in local currency.

- Returns approved visas/eTAs straight into the passenger’s trip file and mobile wallet.

The entire transaction takes under three minutes, keeps the traveler inside your checkout path, and is fully white-labelled with your branding.

Compliance trends creating fresh revenue windows

-

ETIAS goes live in mid-2025

The EU’s long-awaited travel authorisation will affect 1.4 billion visa-exempt visitors. See our detailed ETIAS application guide. Expect a flood of confused North American and Australian tourists—prime candidates for a paid, guided application. -

Digitisation of legacy visas

India, Indonesia, and Saudi Arabia continue to swap paper-on-arrival stickers for mandatory pre-travel eVisas. Each transition resets the playing field and creates urgent demand for automated solutions. -

Airline One-stop Shop ambitions

Full-service carriers are revamping websites to look more like OTAs. Visa services fit naturally next to hotels, insurance, and carbon offsets. -

B2B2C distribution

TMCs and consolidators can resell compliance in their self-booking tools, capturing incremental revenue from corporate travellers who prize time savings over price.

Implementation playbook

- Map the traveller journey

Identify the exact touchpoints (search results, cart page, post-booking email) where a visa prompt feels helpful, not intrusive. - Define ownership & KPIs

Marketing tracks conversion, Ops tracks compliance error rate, Finance tracks net margin. Clear targets prevent turf wars. - Choose integration flavour

- REST API for full control.

- Widget for quick launch (often <2 weeks, no dev backlog).

- White-label app if you have zero engineering resources.

- Price-test & iterate

A/B different fee levels. Remember: travellers value certainty; under-pricing can leave margin on the table. - Educate frontline staff

Gate agents and call-center reps become brand ambassadors when they can confidently say “Yes, we can sort your visa right now.”

What partners are seeing so far

-

Large European leisure OTA

• Attach rate: 44 % on long-haul itineraries.

• NPS lift: +9 points vs control group.

• Chargebacks due to denied boarding: –72 %. -

Regional MEA airline

• Annualised ancillary from visa fees: US $3.1 M on a base of 1.2 M international pax.

• Implementation time: 21 days via SimpleVisa widget.

• Zero fines for incorrect API/PNR data since launch.

(Detailed case studies available on request.)

Frequently asked questions

Isn’t visa processing customer-service heavy?

No. A fully guided flow plus in-app chatbots deflects >90 % of queries. Edge cases route to SimpleVisa’s multilingual support desk, not your call center.

What about data security?

SimpleVisa is SOC 2 Type II certified and compliant with GDPR/CCPA. See our deep dive on E-Visa system security.

Can I test this without code?

Yes—spin up a white-label microsite in under an hour and direct a small traffic sample to validate demand.

Turning compliance into profit: key takeaways

- Border rules are only getting tougher—helping customers navigate them is table stakes.

- Travel brands that own the solution own the revenue—and the loyalty.

- Modern visa platforms make execution trivial, whether you have a 50-person tech team or none at all.

- Early movers capture the lion’s share of attach rate—once customers learn to solve visas elsewhere, the window closes.

Ready to unlock a seven-figure revenue stream while sleeping soundly at night about compliance? Book a SimpleVisa demo and see how fast “must-do paperwork” becomes “nice-to-have profit.”