Multi‑Currency Payments for eVisa Fees: Best Practices to Lift Approval and Reduce Chargebacks

Cross-border card payments may feel instantaneous to travelers, yet for travel brands monetising eVisa services the reality is messier: higher decline rates, currency-conversion surprises, and an outsized share of “friendly-fraud” chargebacks. According to Visa’s 2024 Global Risk bulletin, card-not-present chargebacks grew 22 % year-on-year—much of it driven by poorly localised payment flows. When an application gets declined for payment rather than immigration reasons, everybody loses: the applicant scrambles, approval rates drop, and the travel seller forfeits ancillary revenue.

This guide distils the lessons SimpleVisa has learned from processing millions of eVisa transactions in 180+ currencies. Use these best practices to lift first-attempt approval rates, cut operational headaches, and keep chargebacks below the 0.5 % card-scheme threshold.

Why Multi-Currency Payments Matter in eVisa Flows

- Card schemes treat cross-border traffic as higher risk. Issuers see foreign-currency authorisations and unfamiliar merchant category codes (MCC 4582 for visas) as potential fraud, pushing up decline rates by 6–15 % vs domestic traffic.

- Government fees are fixed in the destination’s currency. If you only bill in USD or EUR, your service fee and the state fee get lumped together, triggering dynamic currency conversion (DCC) and confusing travelers.

- Refund logic is complicated. Partial reversals when a government system rejects the application can leave a foreign-exchange mismatch, opening the door for disputes.

| Metric (2024 global average) | Domestic currency payment | Cross-border FX payment |

|---|---|---|

| First-attempt approval rate | 93 % | 79 % |

| Fraud-related chargebacks | 0.32 % | 0.68 % |

| Average FX & DCC markup | 0 %–1 % | 3 %–7 % |

Source: VisaNet Analytics, Q2 2024.

Best Practices to Lift Approval Rates and Reduce Chargebacks

1. Price in the Traveler’s Local Currency by Default

Displaying a familiar currency reduces cognitive friction and shortens checkout time—key for forms that already ask for passports and photos. SimpleVisa A/B tests show a 4.7 % uplift in completed applications when sellers enable local-currency pricing.

How to implement:

- Pull real-time FX rates via your PSP or an oracle like OpenExchange.

- Lock the rate for at least 15 minutes so the total doesn’t change mid-checkout.

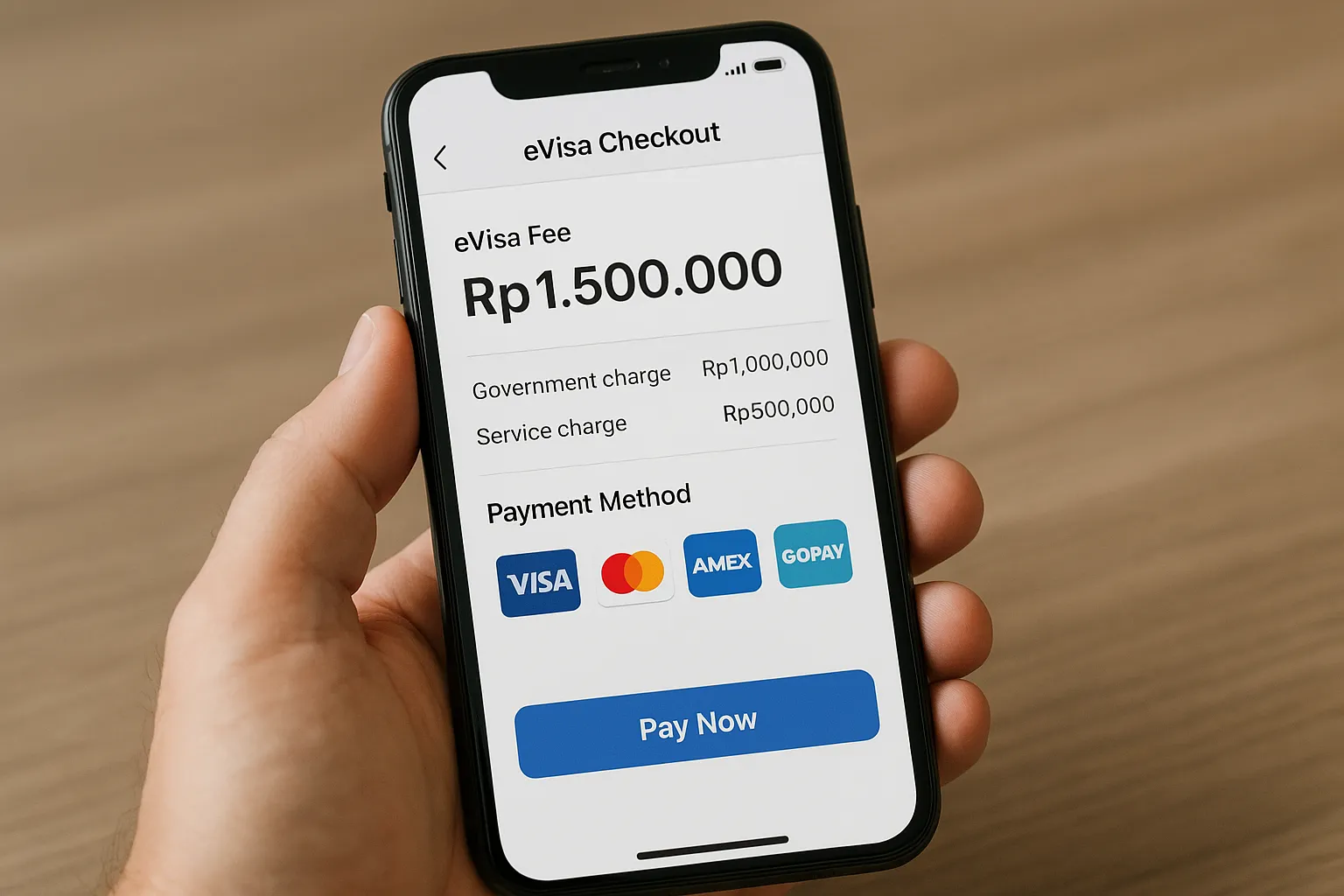

- Itemise fees (Govt $25 • Service $17) but settle as one authorisation to minimise issuer confusion.

Want to see real code? Our sandbox transaction guide includes a multi-currency example call.

2. Use Local Acquiring or Multi-Acquirer Routing

Relying on a single EU or US acquirer to process Indian rupee or Vietnamese dong payments triggers additional scheme-level screening. Payment-orchestration platforms like Adyen, Stripe Connect or CellPoint Digital can route authorisations to a domestic acquirer automatically.

Benefits:

- 3-8 ppt approval lift in emerging-market cards.

- Lower interchange++ and FX fees.

- Fewer “high-risk merchant” surcharges.

3. Offer Region-Specific Alternative Payment Methods

Cards account for barely 31 % of online transactions in Asia-Pacific. Adding instant bank transfers or e-wallets both expands reach and slashes chargeback exposure (most APMs are push-payments and irrevocable).

| Region | High-performing APMs for eVisa fees | Chargeback risk |

|---|---|---|

| India | UPI, Paytm Wallet | None (push) |

| SE Asia | GrabPay, GCash, Dana | None (push) |

| China | Alipay, WeChat Pay | None (push) |

| LATAM | Pix (BR), SPEI (MX), PSE (CO) | None (push) |

4. Adopt 3-D Secure 2.2 With Frictionless Exemptions

Old-school 3DS 1 often killed conversion. Version 2.2 supports rich data sharing so issuers can approve low-risk transactions without an OTP challenge. Key fields you should send:

- Passport-number hash

- Booking PNR

- IP geolocation and device ID

- Visa-type code (tourist, business, etc.)

Issuers treat these as “strong customer authentication” under PSD2, clearing most EU cards in under 400 ms.

5. Use Clear Merchant Descriptors and Instant Receipts

“MCF-4582-SERV-91561” is meaningless to a traveler scanning their statement at 11 p.m. A clear descriptor—“SimpleVisa*Kenya eVisa”—coupled with an instant email/SMS receipt reduces friendly-fraud chargebacks by up to 30 % (Verifi 2024).

6. Isolate Government Fees From Service Fees in Your Ledger

When an immigration authority rejects an application, you often refund only the service fee. If you stored the total as one lump sum, that partial reversal becomes a red flag. Best practice is to:

- Authorise one payment for the traveler, but

- Record two internal line items and be ready to refund the service fee instantly via your PSP’s APIs.

That transparency helps win representment cases should a friendly-fraud dispute still arise.

7. Proactive Refunds Beat Reactive Chargebacks

The longer a rejected applicant waits, the more likely they are to file a dispute. Automate real-time webhook listening on the SimpleVisa application.status.updated event and trigger an auto-refund or a one-click re-application offer (see our playbook in “Visa Denied? 9 Recovery Strategies). Fast refunds keep chargebacks below scheme thresholds and protect your MID.

8. Display Total Cost Early to Prevent “Sticker Shock”

Travelers abandon visa forms when unexpected fees appear at payment (read “Why Travelers Abandon Visa Forms—and 6 UX Fixes). Show an all-inclusive price—government fee, processing fee, and any taxes—in the user’s currency on the previous step. That single tweak can cut late-stage drop-off by 12 %.

9. Tokenise Cards for Subsequent Applications—but Obey PCI Scope

Frequent travelers often need multiple eVisas in a year. Storing network-tokenised cards (Visa Token Service, Mastercard MDES) allows one-click repurchase while keeping you out of full PCI-DSS scope. Always re-request CVV to comply with scheme rules for “customer-initiated transactions” and reduce fraud flags.

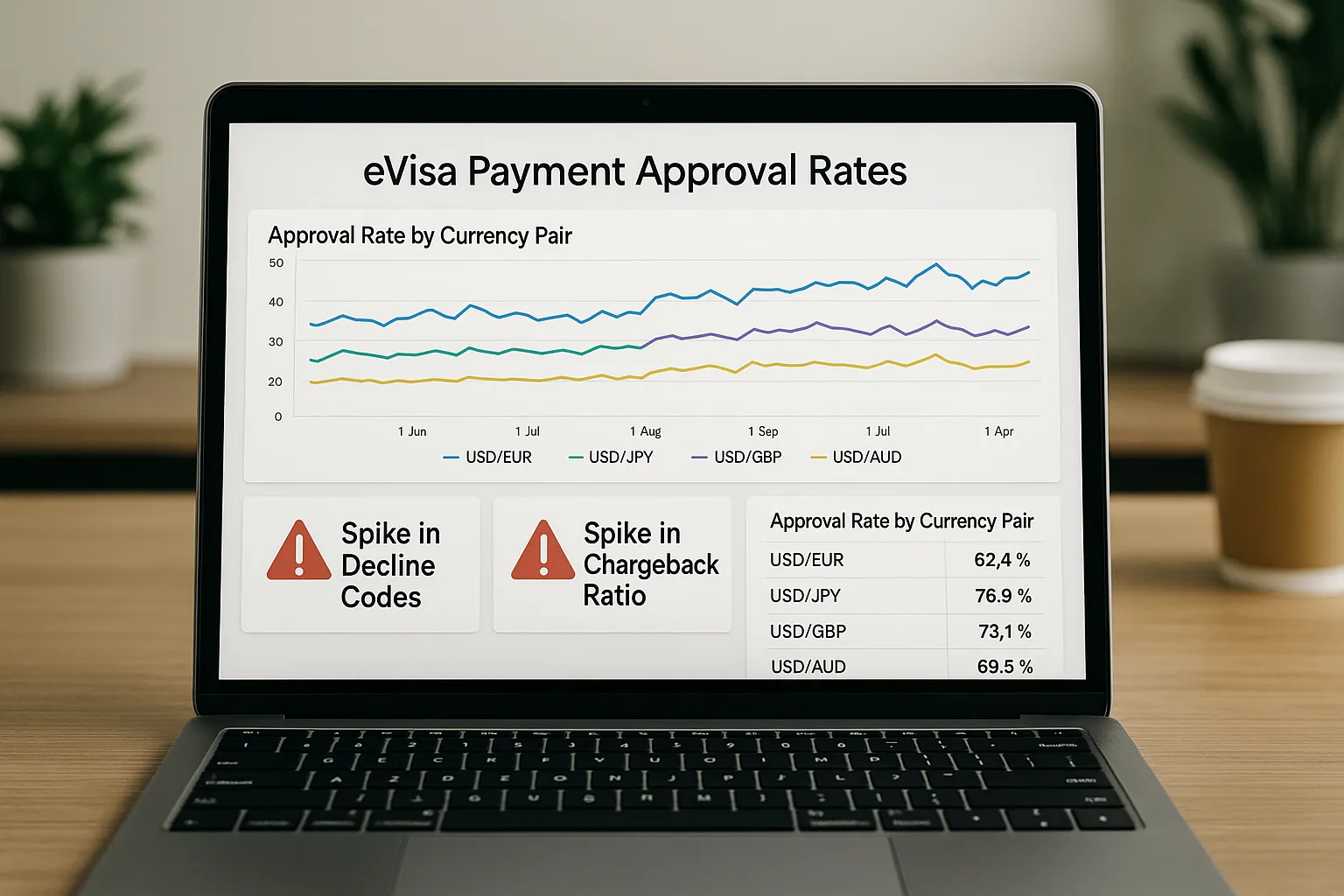

10. Monitor FX Markups and Decline Reasons in One Dashboard

Map issuer decline codes (05, 57, 62, Do Not Honour) against currency pairs. If MYR->TRY declines spike after 18:00 local time, route those attempts to an alternate acquirer or prompt a local wallet. SimpleVisa’s webhook payload already carries the raw ISO 8583 decline reason so you can feed it into BI tools like Looker.

Implementation Checklist

- Choose a PSP with multi-currency settlement in your target corridors.

- Enable 3-D Secure 2.2 and send rich application-level metadata.

- Integrate SimpleVisa’s payment-ready API and test flows in sandbox.

- Configure local-language descriptors and instant receipts.

- Set up webhook listeners for

application.status.updatedanddispute.createdevents. - Track KPIs—approval rate, chargeback ratio, refund latency (see “5 KPIs to Track After Deploying a Visa Management Platform).

The Bottom Line

Multi-currency optimisation isn’t just a finance exercise—it’s a conversion lever. By localising currency, routing intelligently, and automating post-decision refunds, travel sellers can:

- Raise first-attempt approval rates by 8–12 ppts.

- Cut chargebacks by 30–40 %.

- Boost ancillary eVisa revenue without adding checkout friction.

Ready to see these best practices in action? Book a 20-minute demo with the SimpleVisa payments team and learn how our API or no-code widget can start accepting 180+ currencies—with bank-level chargeback protection—before your next booking cycle closes.