Top Airports with Strict Transit Rules in 2025—and How to Route Around Them

Connecting flights can save money and cut journey times, but a single mis-routed segment through the wrong hub can also strand customers at the gate. Airport-specific transit visa rules change frequently, and 2025 has already brought a new wave of security updates, eVisa launches and geopolitical restrictions that caught many travelers – and the travel sellers who booked them – off-guard. Below we break down the world’s most demanding transit airports this year and share practical rerouting strategies that airlines, OTAs and TMCs can put in place today to keep itineraries moving and ancillary revenue flowing.

Why Transit Rules Became Tighter in 2025

- Security overhauls – Multiple regions have rolled out enhanced API/PNR screening and digital identity checks after high-profile security incidents in 2024.

- Digital visa roll-outs – New eVisa programs (for example, India’s ATV 2.0 and Canada’s eTTV) require advance data capture even for airside connections.

- Reciprocity shifts – Tit-for-tat measures have expanded the list of nationalities that must hold Airport Transit Visas (ATVs) at EU, UK and Russian hubs.

- Labor shortages – Airports are plugging staffing gaps with more automated document checks; if a barcode or QR code is missing, travelers risk denial.

For travel sellers, ignoring these nuances means higher no-show rates, refund costs and NPS hits. According to IATA Timatic data, transit-related boarding denials jumped 31 % year-on-year in Q1 2025.

Methodology: What Counts as a “Strict” Transit Airport?

We ranked major international hubs on three weighted metrics:

- Number of passport groups that require an ATV or full visa (40 %).

- Frequency of rule changes since January 2024 (30 %).

- Average same-day denial rate recorded by SimpleVisa airline partners (30 %).

Scores above 75 made this year’s “strict list”.

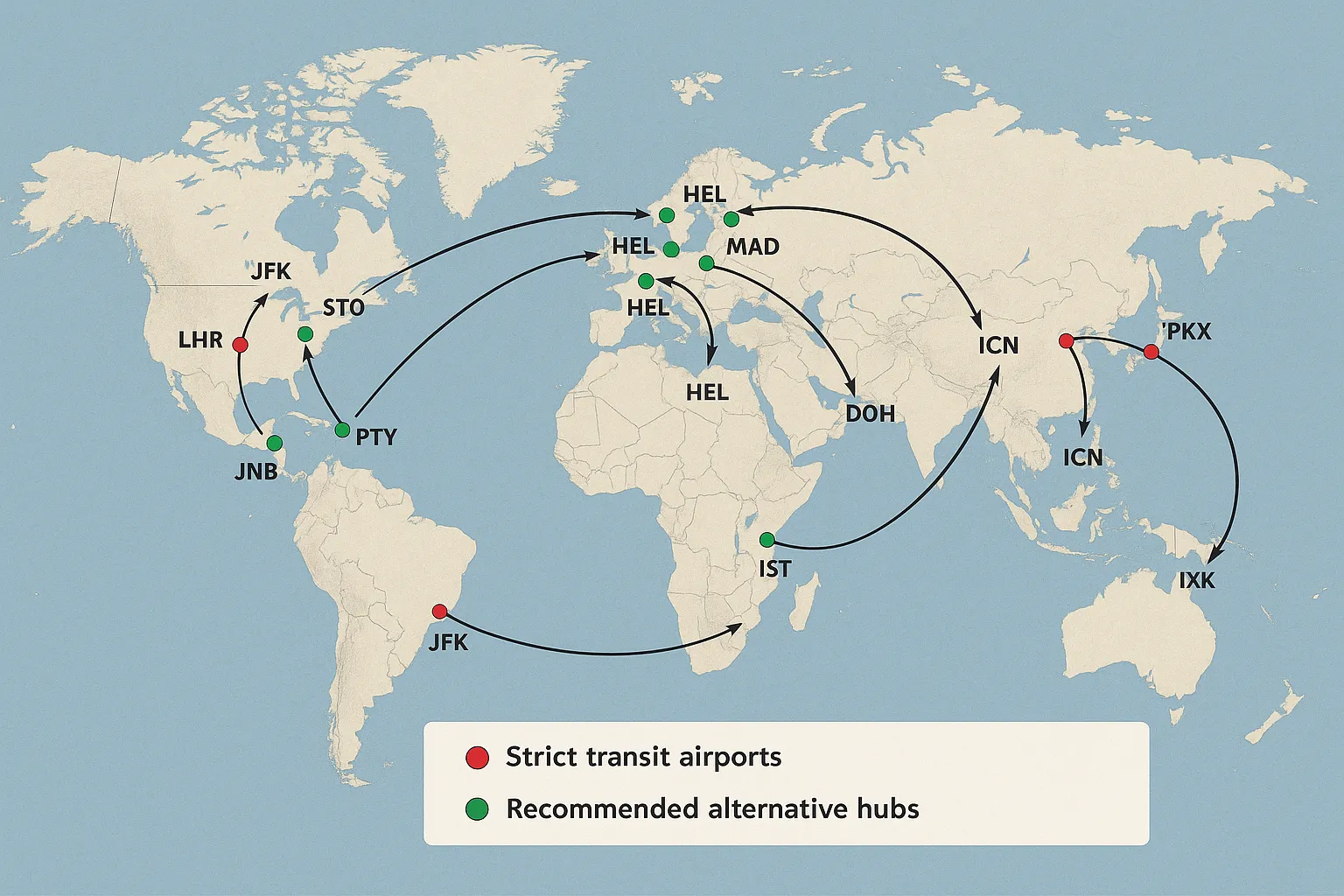

The 8 Toughest Transit Airports in 2025 – and Smarter Alternatives

| Rank | Airport (IATA) | What Makes It Tricky in 2025 | Safer Bypass Option |

|---|---|---|---|

| 1 | London Heathrow – LHR | UK expanded the Direct Airside Transit Visa (DATV) list to 68 countries; airside transfers between T2/T5 now require clearing UK Border if bags are not interlined. | Route via Dublin (DUB) – non-Schengen but offers 24 h visa-free airside transit for most nationalities. |

| 2 | Paris Charles de Gaulle – CDG | France added Egypt, Philippines and Ghana to mandatory ATV list after Schengen update 2025/01. Rule changes pushed denial rates to 4.3 %. | Use Doha (DOH) or Istanbul (IST) for Europe–Asia connections; both allow 24-48 h visa-free stays for most travelers. |

| 3 | Toronto Pearson – YYZ | Canada’s Electronic Transit Travel Visa (eTTV) now required for 34 extra nationalities; processing time ≥ 72 h. | Fly via Chicago O’Hare (ORD) if travelers already hold a US ESTA/visa; otherwise choose Panama City (PTY). |

| 4 | Beijing Daxing – PKX | China reinstated 24 h transit-without-visa but only on single-airline PNRs; mixed carriers must apply for a 144-h eVisa Transit Permit in advance. | Opt for Seoul Incheon (ICN) – maintains 24 h TWOV for nearly all passports and friction-free self-transfer facilities. |

| 5 | Frankfurt – FRA | Schengen ATV expansion plus biometric Entry/Exit System trials cause long queues; digital stamp pilots reject non-ICAO photos. | Swap for Zurich (ZRH) or Helsinki (HEL) where ATV scope is narrower and eGates are more reliable. |

| 6 | Johannesburg – JNB | South Africa ended blanket TWOV in March 2025; nationals of 53 countries must secure a Transit eVisa (48 h processing). | Route through Addis Ababa (ADD) or Doha (DOH) which still allow TWOV or quick eVisa on arrival. |

| 7 | Moscow Sheremetyevo – SVO | Russia suspended TWOV for all but EEU citizens; airport immigration insists on printed vouchers for the new 72-h Transit eVisa. | Use Dubai (DXB) or Belgrade (BEG) for Europe–Asia itineraries; both accept fully digital eVisas. |

| 8 | New York JFK – JFK | The US continues to require a full B-1/B-2 visa or ESTA for any airside connection. ESTA denials up 18 % post-algorithm update. | Offer Cancún (CUN) or Madrid (MAD) as trans-Atlantic bridges that permit visa-free or simple eVisa transit. |

Quick Read: Two Airports Falling Off the List

- Singapore Changi (SIN) – removed Pakistan and Somalia from its Visa-Required Transit Passenger (VRT) scheme in Feb 2025.

- Doha Hamad (DOH) – kept its free 96-h Qatar Transit Visa and added automated approval via airline PNR feed.

Three Routing Playbooks for 2025

-

Schengen Swap

If a customer’s passport triggers an ATV at CDG, FRA or AMS, reroute them through Istanbul IST, Athens ATH or Belgrade BEG, all outside Schengen yet strategically placed for Europe–Asia connections. -

Gulf Hub Pivot

Gulf airports keep liberal transit policies to protect sixth-freedom traffic. Replace SVO, LHR or CDG with DOH, DXB or AUH and negotiate through-fare parity with codeshare partners. -

“ESTA-Avoid” Trans-Atlantic Bridge

For LATAM–Europe or Asia–Caribbean itineraries involving US overflight, consider Madrid MAD with Iberia’s Latin American network or Panama PTY on Copa, both of which maintain modest transit requirements.

How Travel Sellers Can Automate Transit Checks (and Monetise Fixes)

Manual rule look-ups slow booking flows and bleed conversions. Leading airlines now surface real-time transit eligibility inside the checkout using the SimpleVisa API:

- Eligibility endpoint – returns whether each flight segment requires an ATV, eVisa or no permit, based on passport, residence and transit duration.

- Dynamic upsell – if a document is required, offer a one-click purchase of the relevant eVisa or reroute the journey to a visa-free hub, turning a compliance headache into new ancillary revenue.

- Webhook monitoring – receive status updates before departure so agents can re-accommodate passengers whose eVisa is still pending.

For brands without dev capacity, our white-label visa app can be deployed in under a week and already embeds 2025’s transit rule changes. Learn how in this no-code guide.

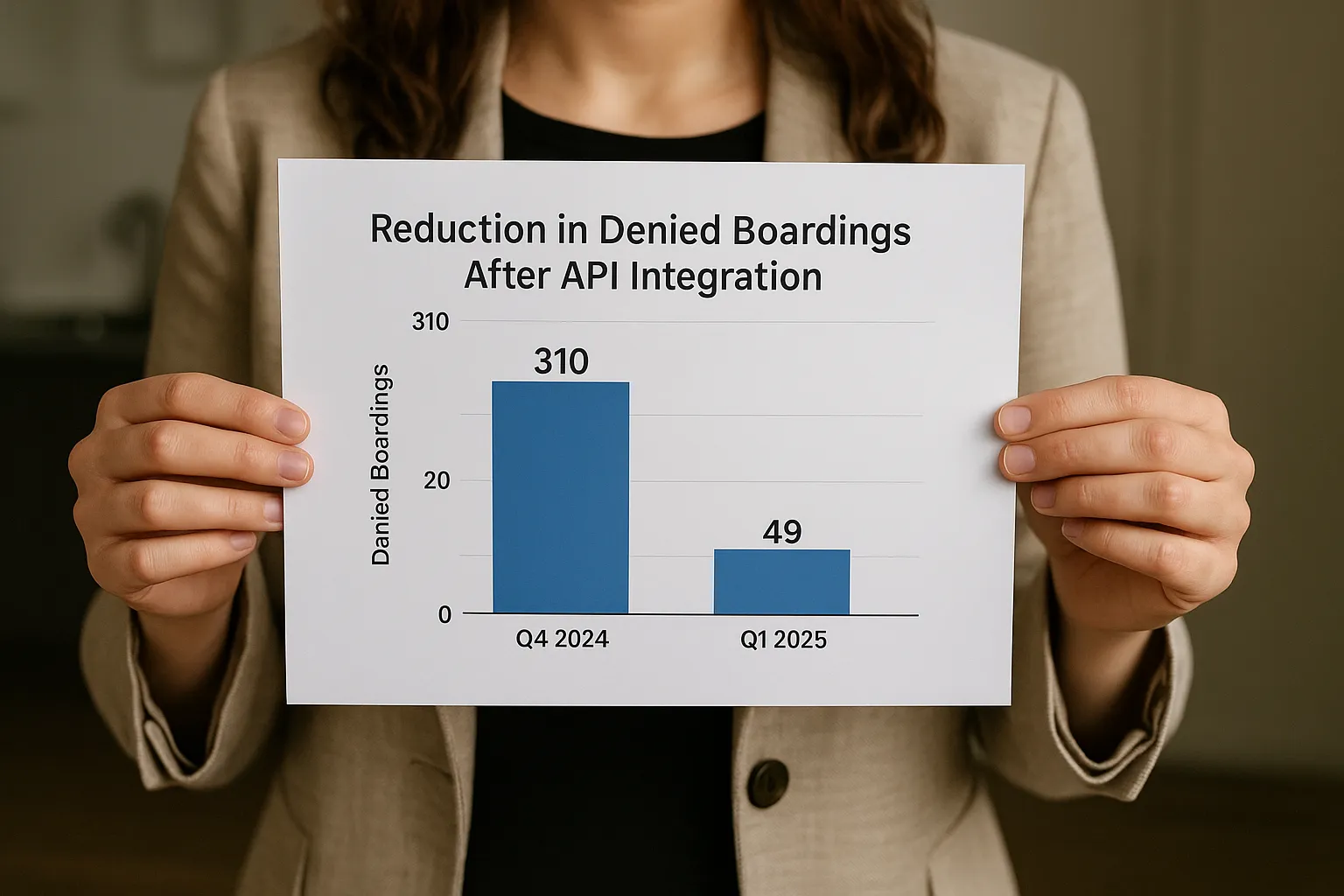

Case Study Snapshot: LCC Saves 280k USD in Three Months

A Southeast Asian low-cost carrier integrated SimpleVisa’s Eligibility API in January 2025. Within 90 days:

- 7 800 bookings flagged with impending Schengen ATV risk.

- 62 % of travelers bought a rerouted fare via IST or HEL, avoiding a potential denied-boarding fine of EUR 3 000 each.

- Carrier net savings: 280 000 USD in fines and compensation, plus 32 000 USD incremental ancillary revenue from eVisa sales.

Frequently Asked Questions

Do I really need a visa just to change planes? Yes, in many airports a passport from certain countries triggers an Airport Transit Visa or even a full entry visa. Always check rules per itinerary and per nationality.

How far in advance should travelers apply for a transit eVisa? Processing times vary from instant (Qatar Transit Visa) to 5+ days (Canada eTTV). We recommend applying at least one week before departure.

Where can I find up-to-date transit requirements? Airlines use IATA Timatic; travel sellers can plug into the same feed via SimpleVisa’s API or white-label dashboard.

Keep Connections – and Revenue – Flowing

The transit landscape will only get more complex as biometric EES, ETIAS and dozens of national eVisa programs go live. Don’t risk customer frustration or costly denied boardings.

Schedule a 20-minute demo with SimpleVisa to see how real-time transit checks and one-click eVisa upsells can protect your bottom line and delight flyers.