Top Travel Visa Companies: What to Look For

Finding the right partner to handle visa requirements can make the difference between a seamless trip (or booking flow) and a last-minute crisis at the border. Whether you are a traveler comparing online agencies or a travel brand looking for an API-driven solution, the market is crowded with providers promising “instant approvals” and “worldwide coverage.” The reality is more nuanced. This guide breaks down what separates the best travel visa companies from the pack and offers a practical framework you can use to make an informed decision.

Why the Choice Matters

A 2024 IATA study estimated that 2.5 percent of international passengers are turned away at the gate each year because of documentation issues. The direct cost (re-accommodation, rebooking, fines) averages 2,000 USD per denied boarding, not including the reputational hit. Choosing a robust visa partner reduces that risk, protects revenue, and improves the traveler experience.

The Two Main Categories of Visa Providers

-

Consumer-facing visa agencies

• Marketed to individual travelers.

• Typically offer web portals or mobile apps where users complete a form and pay a service fee.

• Revenue comes from mark-ups on government fees or premium add-ons like rush processing. -

Technology platforms for travel businesses

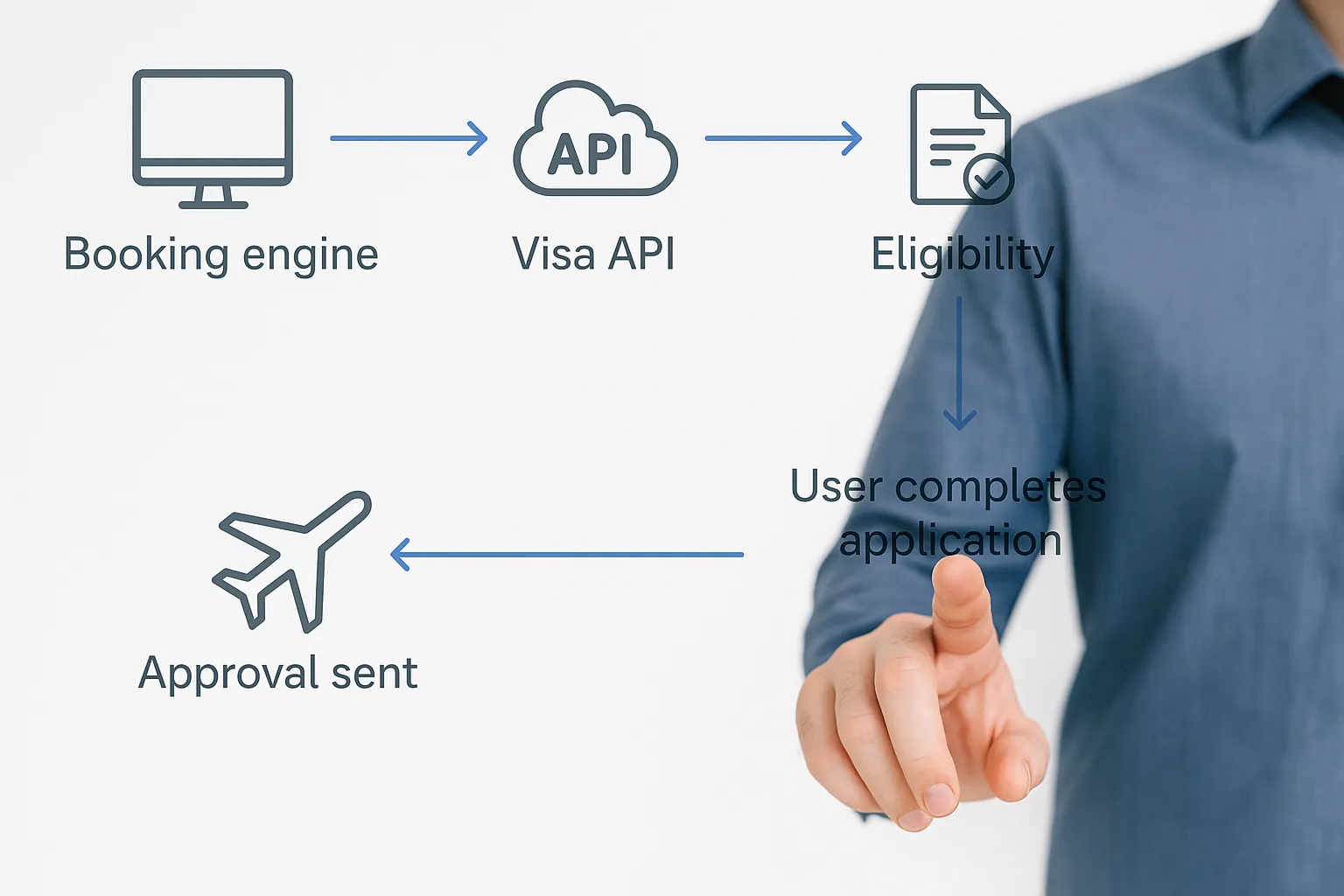

• Deliver visa eligibility data and application workflows via white-label apps, widgets or APIs.

• Focus on seamless integration, compliance dashboards, and ancillary-revenue sharing.

• Examples include SimpleVisa, Sherpa and Viselio.

Understanding which camp a provider belongs to will shape every other evaluation criterion.

Eight Criteria for Choosing a Top Travel Visa Company

1. Global Coverage and Approval Rate

Ask for hard numbers:

| Metric | Why it Matters | Good Benchmark |

|---|---|---|

| Countries covered | Determines user reach | 80+ destinations for B2C; 100+ for B2B platforms |

| Application success rate | Directly impacts customer satisfaction and rework costs | ≥ 95 percent |

| Average processing time | Affects conversion for last-minute bookings | < 48 hours for standard tourist eVisas |

Tip: Coverage lists can be inflated. Request the exact visa types (tourist, business, transit) and the date the database was last updated.

2. Technology Stack and Automation

Modern providers leverage AI form-validation, biometric capture and pre-filled data to cut abandonment. Look for:

- End-to-end digital workflows with no paper hand-offs.

- API or SDK availability so you can embed visa steps inside an existing booking engine.

- Sandbox environments for painless testing (see our own sandbox guide).

Relevant read: How Technology is Transforming Visa Processing: An Insight into SaaS Solutions.

3. Security and Regulatory Compliance

A data breach involving passport scans or payment details can trigger multimillion-dollar fines under GDPR or CCPA. Minimum safeguards should include:

- AES-256 encryption at rest and TLS 1.2+ in transit.

- Role-based access controls and MFA for both staff and end users.

- Independent certifications (ISO 27001, SOC 2) and regular penetration testing.

For a deeper checklist, review Top 8 Security Features to Demand in Any Electronic Visa Solution.

4. User Experience and Multilingual Support

For consumer portals, evaluate:

- Mobile-first design (over 70 percent of eVisa traffic is from smartphones, according to SimilarWeb data).

- Dynamic form validation that flags errors before submission.

- 24 / 7 chat or phone support in multiple languages.

For B2B integrations, examine developer friendliness: clear API docs, code samples, error handling and uptime SLAs.

5. Pricing Transparency and Commercial Models

Typical fee structures include:

| Model | How It Works | Best For |

|---|---|---|

| Flat service fee | Fixed surcharge per application | Individual travelers |

| Revenue-share | Provider and travel brand split service fee | OTAs, airlines |

| Subscription / seat | Unlimited applications for fixed monthly cost | Corporations with heavy travel volume |

Hidden costs (manual document review, re-submission, currency spreads) can erode margins. Demand an all-inclusive pricing sheet with government fees, service fees and payment charges broken out.

Further reading: 7 Revenue-Sharing Models for Online Visa Processing Partners.

6. Integration Effort and Time to Market

- No-code widgets launch in hours but offer limited branding control.

- White-label portals carry your logo without heavy engineering.

- REST or GraphQL APIs provide full UX control but require dev resources.

See our comparison guide: API vs. White-Label App: Which Visa Integration Model Suits You?.

7. Analytics and Reporting

Top providers expose dashboards or webhook events so you can track KPIs such as attach rate, approval rate and average completion time. If you plan to monetize visas, granular reporting is vital for revenue reconciliation.

8. Ancillary Revenue Opportunities

For travel sellers, visa upsells can add 3–10 percent incremental revenue per booking (SimpleVisa network average is 7.6 percent—see the regional study). Look for partners that:

- Provide real-time eligibility prompts during checkout.

- Offer localized pricing and currency conversion.

- Support cross-sell of related services (insurance, fast-track, SIM cards).

Snapshot of Leading Travel Visa Companies

Below is a high-level, publicly available comparison. Features can change quickly—always verify on the vendor’s website.

| Company | Primary Market | Integration Options | Stand-out Feature |

|---|---|---|---|

| SimpleVisa | B2B (airlines, OTAs, cruise lines) | API, widget, white-label app | High approval rate and no-code go-live in under one day |

| Sherpa | B2B & B2C | API, embeddable widget | Destination-specific travel advisories alongside visa rules |

| iVisa | B2C travelers | Web and mobile portal | 24 / 7 multilingual live chat |

| Atlys | B2C travelers (mobile-first) | iOS / Android app | Auto-scans passport and pre-fills forms using OCR |

| Viselio | B2B corporate travel | API, agent dashboard | Bulk corporate visa management |

Disclaimer: Information compiled from vendor documentation and press releases retrieved October 2025.

Red Flags That Signal “Proceed With Caution”

- Vague security language (“bank-grade” encryption with no specifics).

- One-size-fits-all pricing without a breakdown of government versus service fees.

- Outdated coverage claims (e.g., “works in 190 countries” without specifying eVisa versus traditional sticker visas).

- Manual email submissions of passport scans rather than encrypted web uploads.

- No public uptime status page or SLA.

Running a 30-Day Pilot Before a Full Roll-out

- Define success metrics (conversion lift, attach rate, time on task).

- Select a low-risk market—for example, short-haul destinations with high eVisa adoption.

- Integrate via widget or staging API and route a percentage of traffic.

- Monitor real-time dashboards for errors, drop-offs and approval outcomes.

- Collect qualitative feedback from customers and agents.

- Iterate and A/B test messaging, positioning and upsell placement.

- Negotiate long-term commercial terms once KPIs hit target.

For a deeper playbook, see Ultimate Guide to Marketing eVisa Services During the Booking Flow.

Key Takeaways

- Evaluate providers on data, not slogans. Coverage breadth, approval rate and processing speed are the big three metrics.

- Security and compliance must be non-negotiable. Look for audited certifications.

- Integration flexibility (API, widget, white-label) determines how fast you can deploy and how much UX control you retain.

- Transparent pricing and revenue-share models convert a compliance headache into a profit center.

- A structured pilot minimizes risk and surfaces insights before a wide release.

Choosing a visa partner is ultimately about trust and alignment with your customer experience goals. If you are exploring options, SimpleVisa offers a developer sandbox, no-code widgets and an API designed to get you live in hours—not months—while maintaining industry-leading security and approval rates. Visit simplevisa.com or request a demo to see how we can help you turn border-crossing compliance into a competitive advantage.