Visa Demand Trends 2026: Forecast for Travel Brands

Travel in 2026 will be defined by two forces moving in parallel, record cross‑border mobility and stricter digital pre‑clearance. For travel brands, that means visa demand will be both larger and more time sensitive. This forecast distills the macro signals, regional outlook, segment shifts, and the practical actions airlines, OTAs, cruise lines, and TMCs should take to convert that demand into revenue while keeping customers compliant.

The macro signals shaping visa demand in 2026

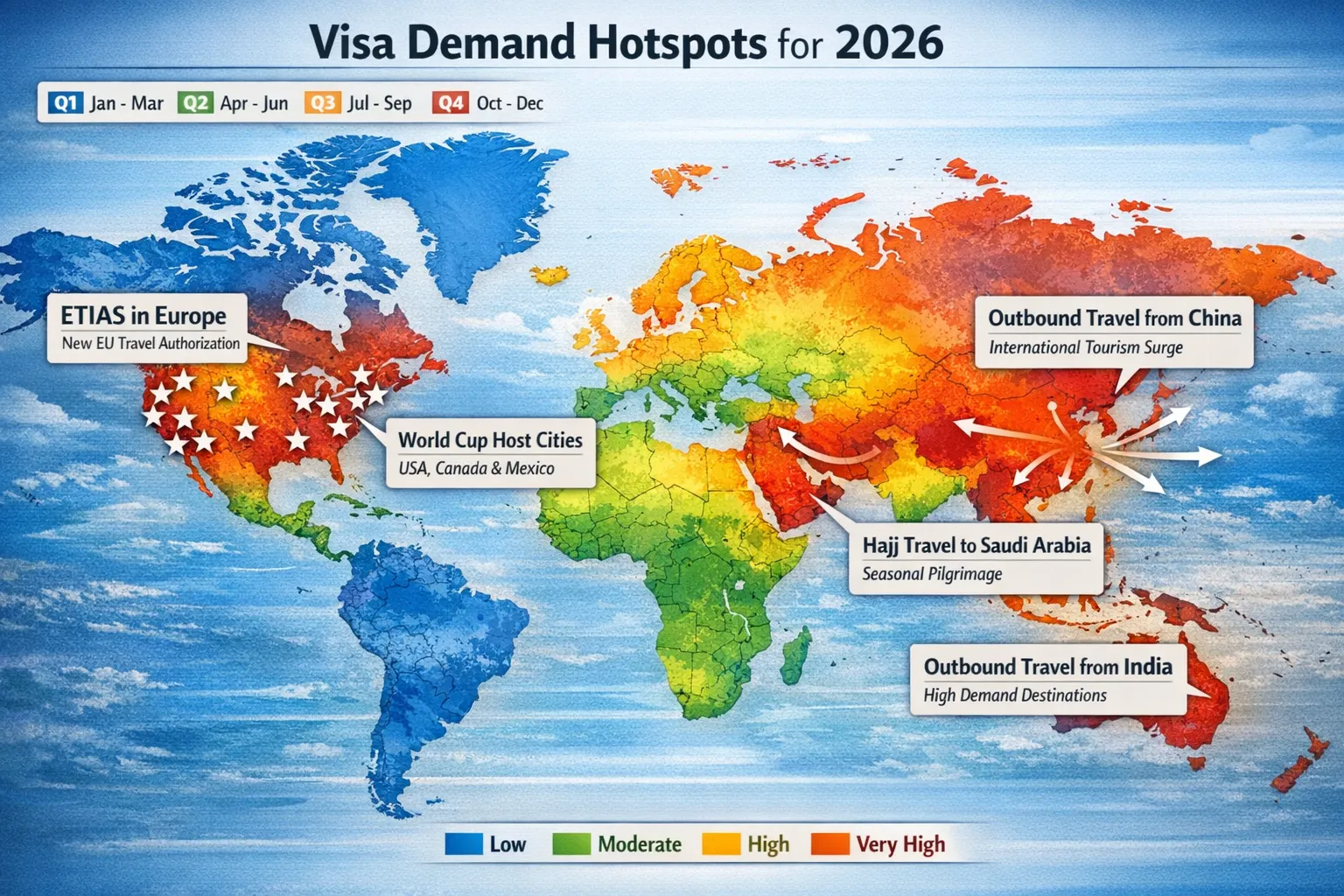

- Policy digitization accelerates. Europe’s ETIAS is expected to be fully in effect by 2026, the UK ETA continues to expand, and more countries are replacing paper stickers with eVisas and eTAs. This raises the number of trips that require an online authorization, even for traditionally visa‑exempt travelers.

- Mega events compress timelines. The FIFA World Cup 2026 across the United States, Canada, and Mexico will create concentrated surges of authorizations, especially for multi‑country itineraries. The Milan–Cortina Winter Olympics in February will do the same across Schengen entry points.

- Corporate travel normalizes. Global flight capacity and budgets continue to rebound, which increases short‑lead, multi‑entry business authorizations and same‑week filings.

- Asia outbound recovers. As capacity returns and consumer confidence rises, expect strong outbound applications from India and China to Schengen, GCC, and Southeast Asia, with continued growth to North America.

- Cruise and multi‑stop trips grow. Multi‑port rules mean more pre‑trip checks and bundled visas per traveler, which elevates upsell opportunities inside booking flows.

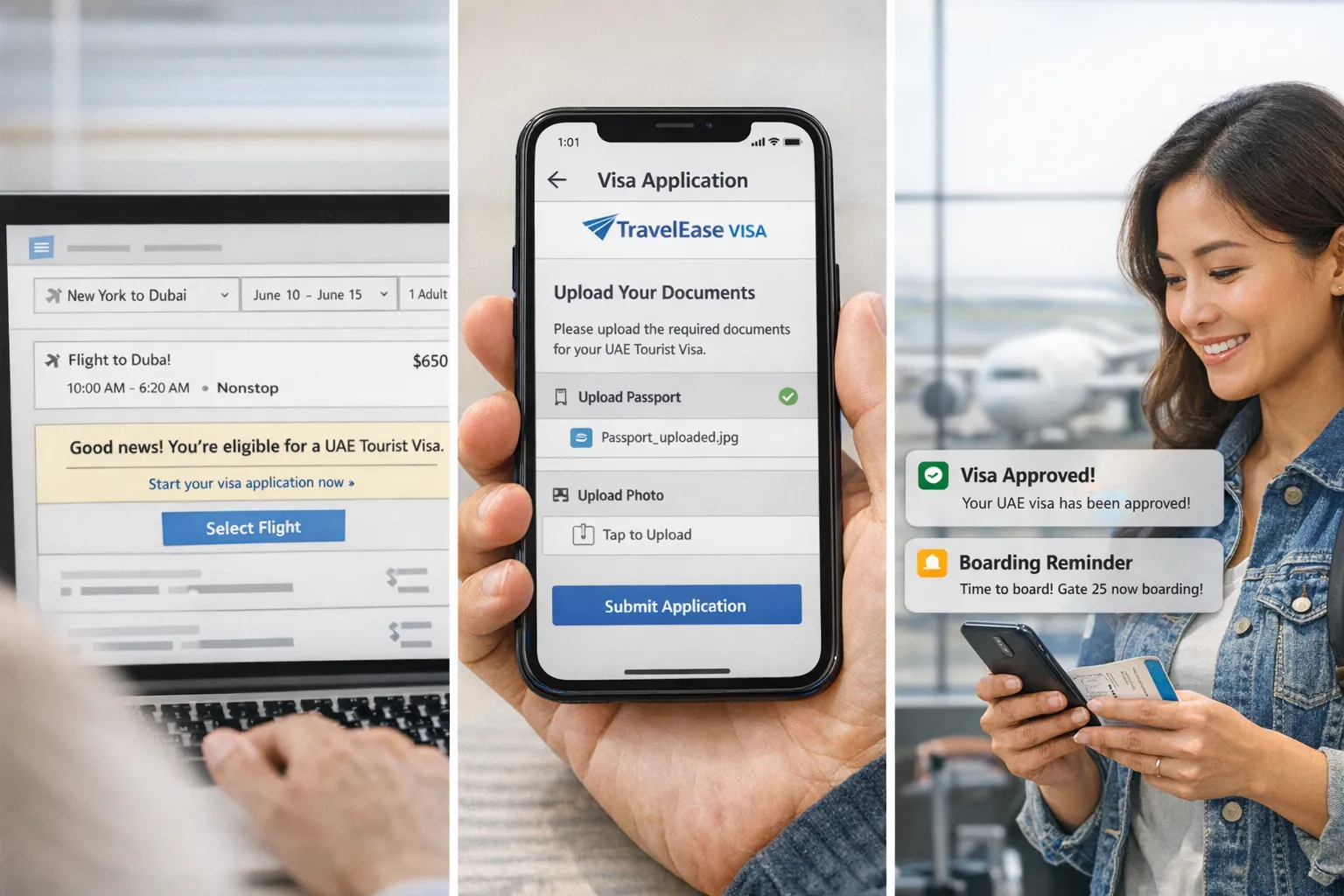

- Traveler expectations harden. Mobile‑first users want real‑time eligibility, upfront costs in their currency, and guided applications without leaving the checkout. Brands that fail to surface requirements early will see higher abandonment.

Regional outlook: where visa demand will spike

Europe (Schengen)

ETIAS pre‑screening will make short‑stay authorizations a default step for many visitors. Expect two high‑pressure windows, Feb 2026 around the Winter Olympics and June–September for peak leisure season. Airlines and OTAs should expect more last‑minute ETIAS purchases and queries at check‑in. Clear messaging on validity and the 90‑days in 180‑days rule will reduce denied boardings.

Recommended moves: embed ETIAS eligibility at search and fare review, add an in‑path purchase option, and send T+0 post‑booking reminders with status tracking.

North America (United States, Canada, Mexico)

World Cup travel demand will push short‑haul and long‑haul bookings into multi‑entry authorization patterns. ESTA, Canada’s eTA or TRV, and Mexico’s entry permits will be top of mind, especially for travelers crossing borders between match cities. Expect a wave of re‑checks the week before departure as fans finalize tickets and routing changes. See our practical playbook for this event in the FIFA 2026 Visa and ETA Guide on SimpleVisa.

Middle East and GCC

Tourism growth and major events continue to drive eVisa uptake in the region. Saudi Arabia’s religious travel windows, plus year‑round leisure in the UAE and Qatar, sustain steady applications. Policy discussions around a unified GCC tourist framework signal more digital pre‑clearance and standardized rules over the medium term, which would simplify itineraries but increase pre‑trip filings.

Asia Pacific

Japan, Thailand, Indonesia, Vietnam, and Australia remain high‑demand corridors with a strong mix of tourism and business. Expect continued upgrades to eVisa portals and mobile experiences, which will lift conversion if surfaced in booking flows. Outbound India will be one of the largest drivers of Schengen and GCC visa demand.

Africa

East Africa saw early adoption of eTAs and eVisas, reducing friction for safaris and regional circuits. In 2026, more carriers and OTAs can monetize pre‑trip compliance by presenting clear rules for multi‑country safaris and by bundling insurance and document storage.

Latin America

Countries across the region continue to adjust digital authorization policy. Expect occasional toggles between visa‑free and eVisa for select nationalities as governments calibrate tourism and security goals. Brands need live data feeds and customer messaging that adapt quickly.

Traveler segments driving growth in visa applications

- Event travelers. Fans and volunteers create clustered travel windows with multi‑country routings, which increases the number of authorizations per traveler.

- Business and MICE. Higher frequency trips, short lead times, and preference for priority processing make in‑path upgrades and service fees attractive.

- Cruise and tour groups. Multi‑port itineraries raise complexity, which is ideal for guided, white‑label visa journeys bundled with documentation storage.

- Digital workers. Long‑stay remote work permits are stabilizing, but short‑stay business and tourism eVisas remain the more common demand in 2026.

- Wellness and retreat travel. Demand for retreats in Bali, India, and Thailand is buoyed by broader consumer interest in balance and mindfulness. The rise of wellness content and retail ecosystems, for example the growth of holistic wellness lifestyle brands, signals durable interest in this segment that translates into steady visa applications for Asia.

Booking behavior you should plan for

- Lead times shorten. More applications will be filed inside two weeks of departure. That elevates the value of in‑flow approvals and automated status alerts.

- Mobile dominates. Uploads, payments, and status checks happen on phones. Mobile UX and document capture must be bulletproof or customers will abandon.

- Attach rates vary by corridor. Regions with mandatory pre‑clearance, low fees, and shorter booking windows show the highest uptake when offers are embedded. See SimpleVisa’s analysis in Which Regions Generate the Highest eVisa Upsell Rates for attach‑rate benchmarks and the drivers behind them.

2026 operational calendar for visa demand

| Quarter | Demand drivers to watch | What to ship this quarter | Target operating metrics |

|---|---|---|---|

| Q1 2026 | Winter Olympics entry peaks, early spring leisure, corporate travel ramps | Finalize ETIAS and UK ETA flows, localize copy, enable priority processing and re‑application wizards | Application completion rate above 85 percent, median time to submit under 9 minutes |

| Q2 2026 | Summer booking wave for Europe and North America | Place eligibility checks at search and fare review, launch in‑path pricing, add reminders at T+0, T+7, T+21 | Visa attach rate lift 2 to 4 points, reduction in support tickets per 1,000 bookings |

| Q3 2026 | Peak leisure travel, cruise season in both hemispheres | Deploy group and family flows, enable multi‑traveler uploads and shared status, add check‑in validation APIs | Fewer denied boardings, application approval rate gain of 1 to 2 points |

| Q4 2026 | Shoulder season, corporate travel and festive peaks | Run cohort pricing tests, ship denial‑recovery journeys, refresh 2027 policy rules | Cost per resolved ticket down 15 percent, re‑application conversion above 25 percent |

Product and merchandising playbook for 2026

-

Put visa eligibility before fare lock, not after payment. A single inline prompt that confirms whether a traveler will need an eVisa or ETA reduces friction and improves trust. Keep the message plain language and destination specific.

-

Offer a guided, branded application in the booking flow. No redirects if you can avoid it. If you are early in your roadmap, a white‑label application portal is a fast way to validate demand, then graduate to an API for deeper control.

-

Price with clarity. Show government fee, service fee, and optional add‑ons in the user’s currency. Upfront transparency reduces cart anxiety and chargebacks.

-

Bundle convenience. Priority processing, document scanning, SMS updates, and re‑application support are high‑margin, high‑satisfaction add‑ons for late bookers.

-

Build denial‑recovery journeys. If an application is refused, offer one‑click re‑application with corrected data, alternative routes that do not require a visa, or a travel credit. Protecting the booking pays for itself.

-

Localize for your top five nationalities. Language, payment methods, and examples should match the traveler’s passport and destination pairings.

-

Automate post‑booking. Send reminders, status updates, and pre‑boarding checks. Surface missing documents early to avoid airport surprises.

-

Measure and iterate. Track visa‑related conversion, ancillary revenue per booking, completion time, approval rate, and support contacts. Optimize copy, placement, and pricing based on this telemetry.

For detailed KPI definitions and dashboards, see SimpleVisa’s guide 5 KPIs to Track After Deploying a Visa Management Platform.

Data signals to monitor monthly

- Policy changes that affect eligibility, fees, or processing times for your top 20 routes

- Average lead time between booking and visa submission, segmented by origin and destination

- Approval and denial codes, to refine pre‑check logic and micro‑copy

- Support contact reasons, to identify where copy or UI needs fixes

- Mobile versus desktop completion rates, to prioritize UX investments

Technology choices that reduce risk and lift revenue

Travel brands do not need to build visa infrastructure from scratch to capture 2026 demand.

- No‑code implementation. Add a compliant visa widget to checkout in under an hour. Ideal for validating demand and lifting attach rate quickly.

- White‑label application app. Launch a branded portal that handles guided applications, document capture, payments, and notifications with your logo and colors.

- API integration. Embed eligibility checks, dynamic forms, and status tracking directly in your booking flow. Use webhooks to power proactive operations such as pre‑boarding verification.

SimpleVisa supports all three patterns, with visa processing automation, guided customer applications, premium eVisa management, and custom data services. The platform is already live on 400 plus partner sites, and no‑code options make it easy to start quickly, then graduate to an API when you are ready.

Risk management for a volatile policy landscape

- Build in redundancy. Offer alternative routes or dates when a rule change affects the original plan.

- Keep content evergreen. Replace generic FAQs with destination‑specific micro‑copy and contextual tips inside the form.

- Protect payments. Use clear refund policies for service fees and government fees, and present these before checkout.

- Respect privacy. Ask only for required data, store it securely, and explain why it is needed. Transparent UX raises completion and reduces drop‑offs.

Bottom line for 2026

Visa demand will be higher, more mobile, and more compressed around events and seasons. Brands that surface requirements early, guide customers through compliant applications, and automate status from purchase to boarding will win share, reduce operational risk, and grow ancillary revenue.

If you want to capture that demand without slowing your roadmap, integrate SimpleVisa where it fits best for you, API in your booking flow, a white‑label app for a fast launch, or a no‑code widget you can ship this week.

Ready to forecast, monetize, and de‑risk your 2026 visa demand, explore SimpleVisa to see how travel brands use automated visa checks and guided applications to convert more bookings with fewer support tickets.