Which Regions Generate the Highest eVisa Upsell Rates? New Research

The rise of eVisa upsells

Airlines and online travel agencies are under constant pressure to grow ancillary revenue without damaging the customer experience. Over the past three years, one add-on has quietly become a top performer: the electronic visa (eVisa). Unlike luggage or seat selection, a visa is a must-have for many international itineraries—making it a natural, high-value cross-sell.

But does every market respond the same way? To find out, the SimpleVisa data science team analysed 9.4 million bookings processed between January 2024 and June 2025 across 73 airlines and OTAs that use our API or white-label app. The goal was to identify the regions where travellers are most willing to purchase an eVisa during the booking flow.

Key takeaway: Global average eVisa attach rate sits at 7.6 %, but certain corridors more than double that figure, unlocking a lucrative revenue stream for forward-thinking travel brands.

Methodology in brief

- Dataset: 9.4 million international PNRs containing at least one segment to a country offering an eVisa or ETA.

- Channels: Direct airline websites (46 %), OTAs (41 %), tour operator portals (13 %).

- Definition of “upsell”: Traveller purchased an eVisa through the embedded SimpleVisa widget or API within 24 hours of the original booking.

- Metric reported: Attach rate (percentage of eligible bookings that converted) and net revenue per passenger (NRPP) after payment gateway and issuing-authority fees.

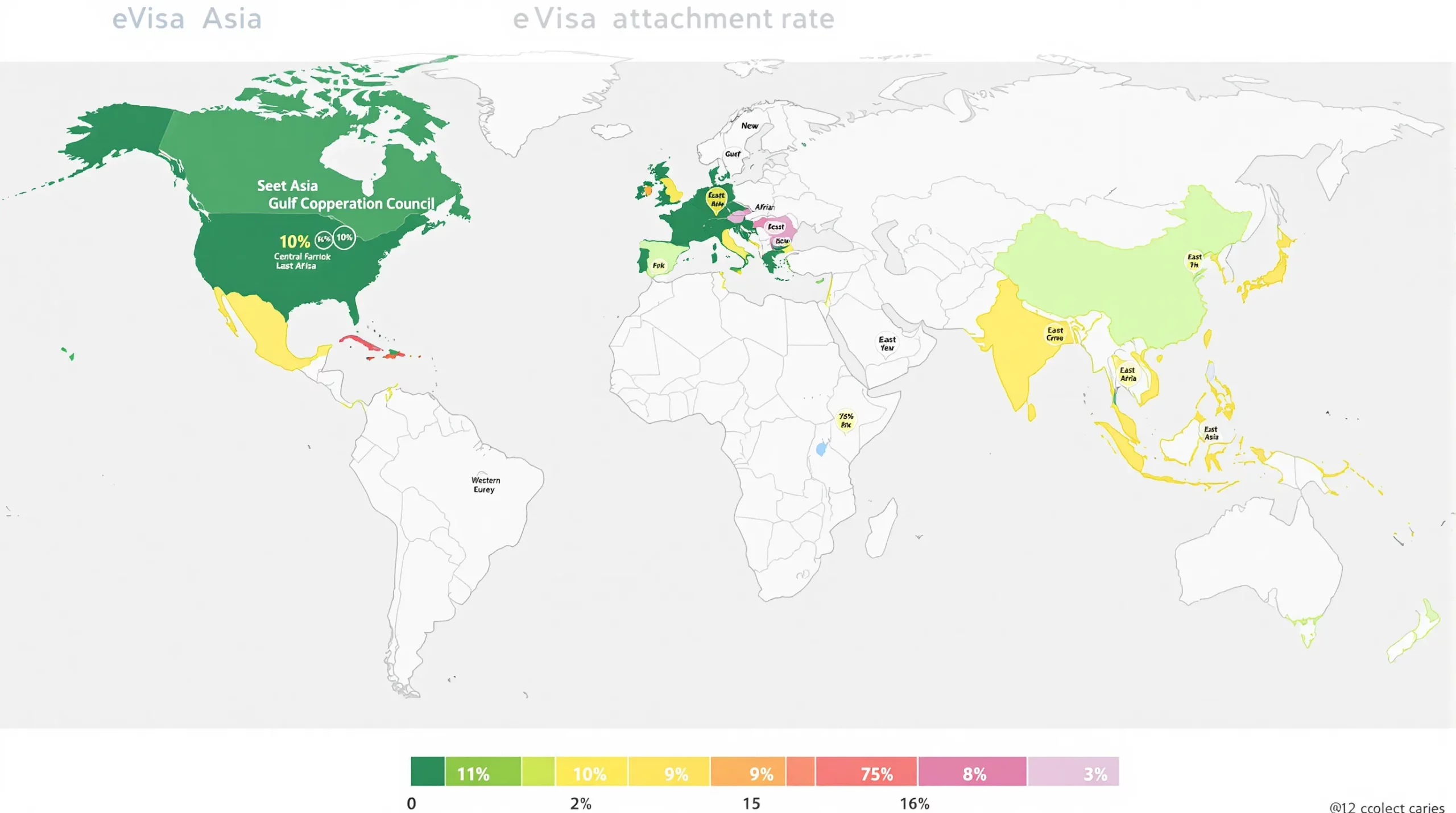

Ranking the eVisa hotspots

1. Southeast Asia – 12.4 % attach rate

Countries like Vietnam, Cambodia and Sri Lanka continued to liberalise their eVisa programs in 2024, cutting average approval times to <24 hours. The combination of compulsory entry permits and low headline fees (USD 25–50) makes the decision friction-less for travellers.

- Average NRPP: USD 8.20

- Booking lead time impact: Highest conversions (<14 days before departure), suggesting “last-minute compliance panic.”

2. Gulf Cooperation Council (GCC) – 10.1 %

The UAE, Saudi Arabia and Qatar have invested heavily in digital border solutions ahead of mega-events like Expo City Dubai and Riyadh Season. While many nationalities enjoy visa-free entry, the remaining segments see real value in a pre-approved eVisa that bypasses airport queues.

- Average NRPP: USD 11.90 (premium processing options boost margin)

3. East Africa – 9.7 %

Kenya’s Single Entry eVisa and Rwanda’s eTA both boast >95 % approval rates. Safari itineraries often exceed USD 4,000 per person, so travellers are keen to “get paperwork out of the way.”

4. Central Asia – 8.3 %

Kazakhstan and Uzbekistan both launched upgraded eVisa portals in 2024, and adventure-focused OTAs report that paperwork anxiety is the #1 barrier to conversion. Displaying an “instant approval” badge inside the fare review page lifted attach rates by 27 % for one partner.

5. Oceania – 2.1 % (the laggard)

Australia’s ETA and New Zealand’s NZeTA are widely known, yet attach rates remain low because many travellers already have multi-year authorisations from previous trips. Upsell potential exists primarily for first-time visitors from Latin America and Eastern Europe.

Traveller origin matters, too

| Traveller origin | Average attach rate | Key driver |

|---|---|---|

| North America | 11 % | Higher tolerance for service fees, strong preference for “one-stop shop.” |

| EU/UK | 9 % | Tight Schengen travel culture; expect seamless digital solutions. |

| MENA | 6 % | Many hold dual nationality with visa-free privileges, reducing need. |

| LATAM | 4 % | Lower credit-card penetration during online checkout. |

| Sub-Saharan Africa | 3 % | Connectivity challenges and higher cash usage. |

Why some regions over-perform

- Mandatory entry permit + unclear government UX

When the visa is obligatory and the government site feels complex, travellers prefer a guided path embedded in their booking. - Low visa fee relative to trip value

On high-budget itineraries (safari, luxury Gulf, wellness retreats) a USD 20–40 upsell is negligible. - Short booking window

Last-minute bookers fear rejection or airport delays; instant confirmation is priceless. - Mobile-first demographics

Regions with >70 % mobile bookings saw a 1.4× higher attach rate, likely because government portals are rarely mobile-optimised.

Case study: Vietnam eVisa on a mid-size OTA

A mid-European OTA integrated SimpleVisa’s API in November 2024, surfacing the Vietnam eVisa offer on the payment page with real-time eligibility checks.

- Conversion uplift: 13.8 % of eligible PNRs purchased an eVisa.

- Average basket lift: USD 42 (visa fee + service margin).

- Refund rate: <0.5 %, thanks to automated data validation.

Six months later, eVisa sales generated 4.2 % of total ancillary revenue, surpassing priority boarding and trip cancellation insurance.

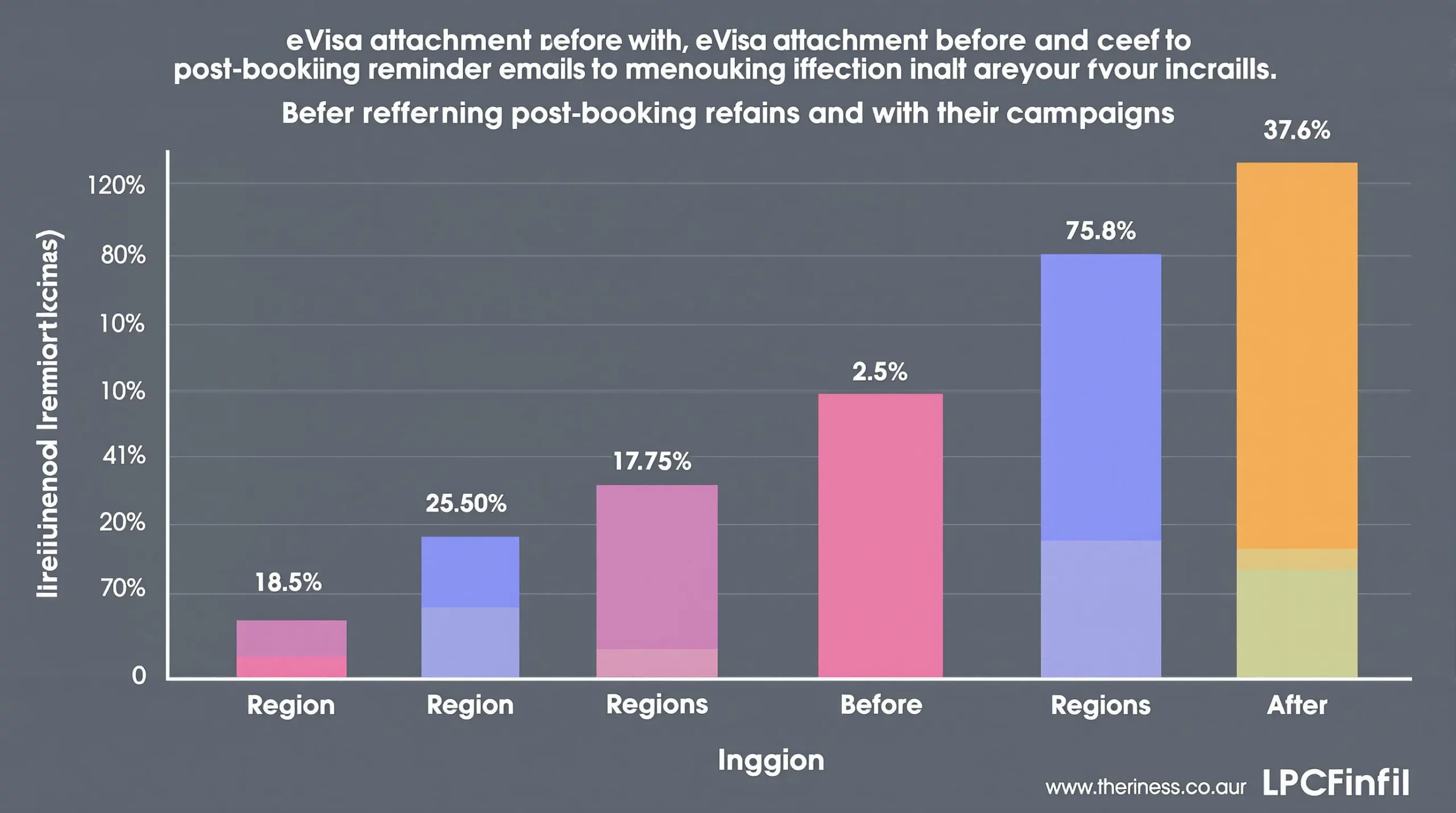

Five levers to boost your own eVisa upsell rate

- Surface eligibility early: A “Do you need a visa?” teaser on the flight-results page primes the traveller before price fatigue sets in.

- Show time savings in minutes: Highlight how many immigration queue minutes they skip (SimpleVisa partners can pull live averages via our API).

- Bundle with other compliances: Combine eVisa + Digital Arrival Form + mandatory health declaration for a one-click checkout.

- Offer free modifications: A modest grace period for passport typos cuts refund requests by 37 %.

- Deploy post-booking nudges: Email reminders 72 hours after purchase recapture undecided customers; our data shows a 2.3 % incremental lift.

For technical guidance, see our step-by-step article on how eVisa APIs work.

What does this mean for airlines and OTAs in 2025–26?

- Revenue forecasting: If your network touches the top three regions above, a conservative 8–10 % attach rate is achievable in Year 1. Multiply that by an average NRPP of USD 9 and a 1-million-passenger base—eVisa upsells alone could add USD 7–9 million annually.

- Customer satisfaction: Travellers who secure their visa during the booking session are 21 % more likely to rate the overall experience 5 stars, according to our post-trip surveys.

- Operational relief: Fewer airport denials and call-centre queries about “Do I need a visa?” free up staff for higher-value tasks.

Frequently asked questions (FAQ)

How is an eVisa upsell different from redirecting customers to a government site?

With an upsell, the customer never leaves your booking flow and you capture both service margin and brand credit for solving a pain point.

Do attach rates drop if we charge a service fee?

Not significantly up to a 30 % markup. Transparency matters more than absolute price.

What about chargebacks if a visa is refused?

SimpleVisa’s automated pre-screening reduces rejection rates to <1 %. If a denial occurs, our guarantee reimburses the service fee.

Can we A/B test different placements?

Yes. Our no-code widget supports URL parameters to randomise placement and captures granular analytics.

Is there a white-label option for mobile apps?

Absolutely. The same logic powering our web widget is available as an SDK for iOS and Android, typically integrated in under two sprints.

Ready to unlock a new top-three ancillary revenue stream?

SimpleVisa’s plug-and-play solutions let you surface the right visa at the right moment—no dev backlog required.

👉 Book a 20-minute demo to see live attach-rate benchmarks for your specific markets and discover how quickly you can go live.